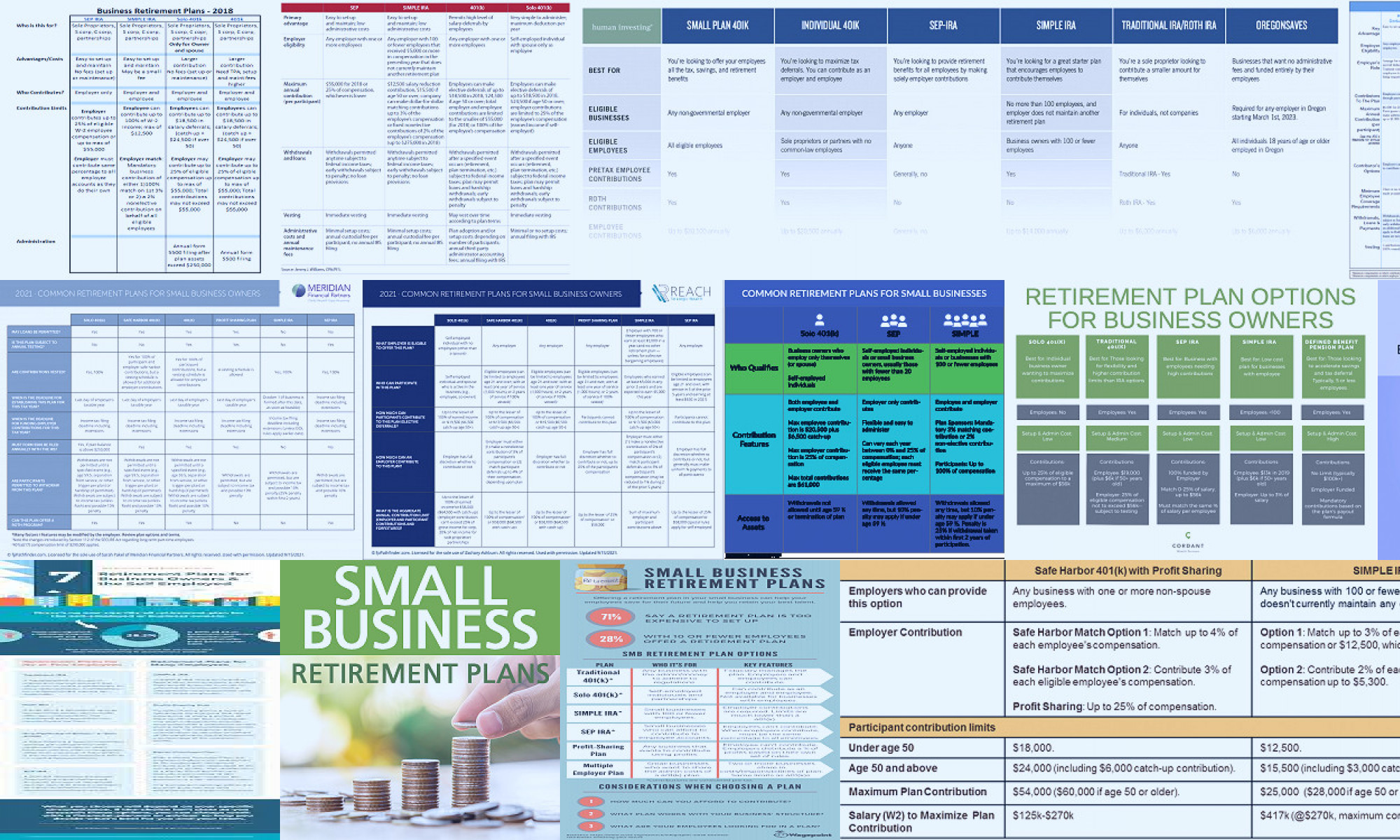

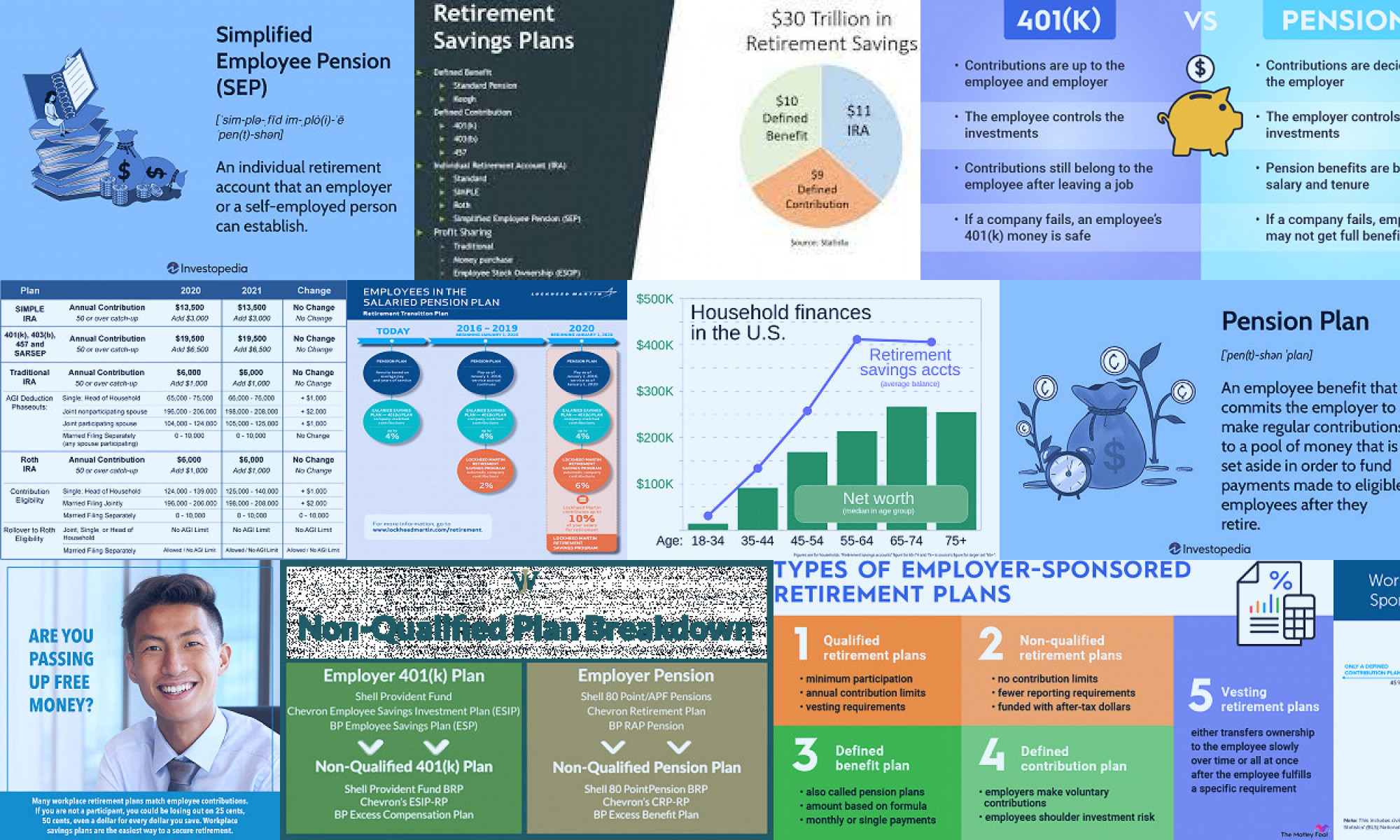

Best One Person Small Business Retirement Plan

The best one-person small business retirement plan is a self-directed retirement savings program designed specifically for self-employed individuals or small business owners. This plan allows for higher contribution limits compared to traditional retirement plans, offering tax-deductible contributions and tax-deferred growth. It's an ideal option for those looking to secure their financial future post-retirement while reducing their current tax liability.Visit site