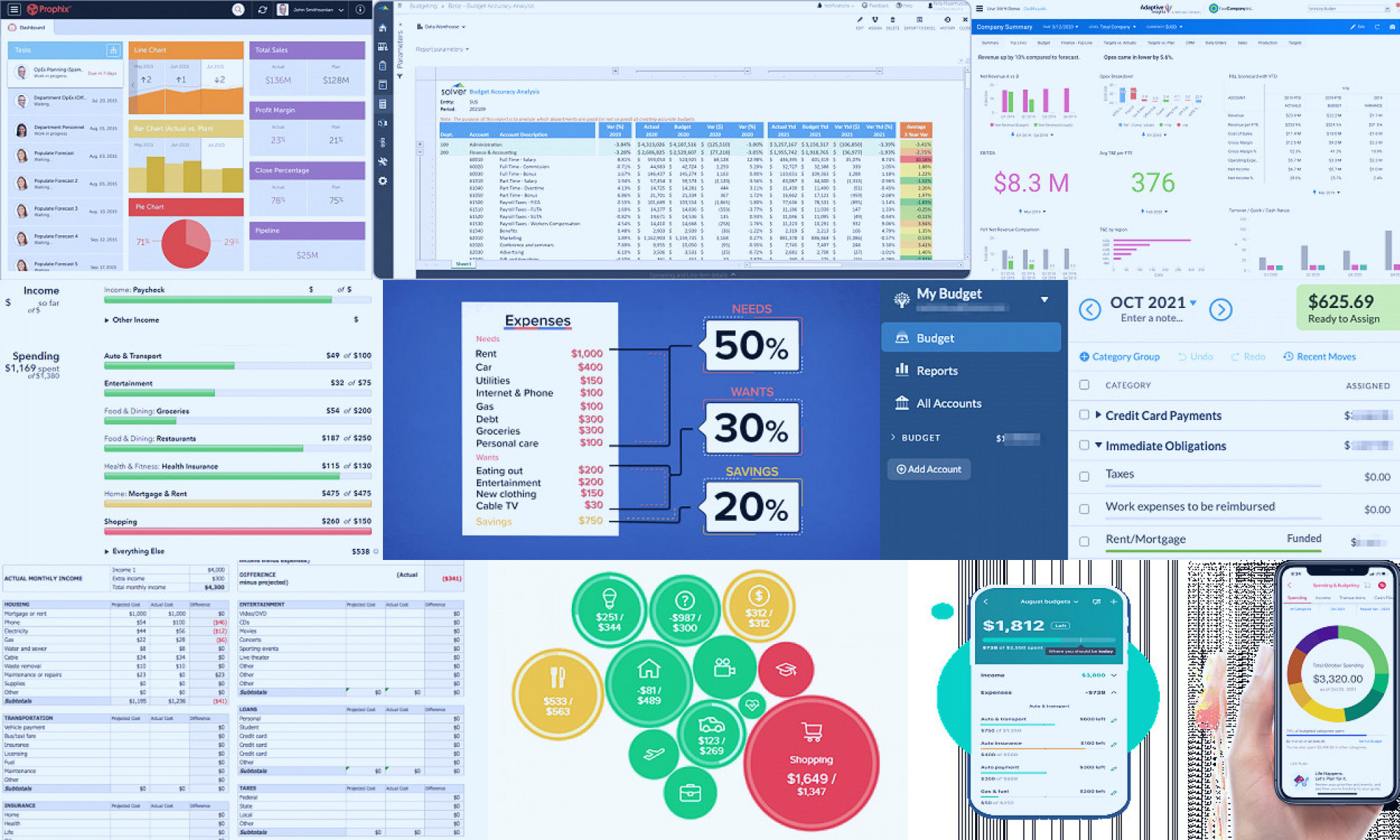

Budgeting Tools

Budgeting tools are financial management aids designed to help individuals and businesses create, monitor, and stick to their financial plans. They provide an organized and systematic approach to tracking income, expenses, and savings. These tools can be simple spreadsheets, mobile apps, or complex software systems. They aid in avoiding overspending, managing debts, and saving for future goals. By providing visual representations and actionable insights, budgeting tools make financial planning less intimidating and more accessible.Visit site