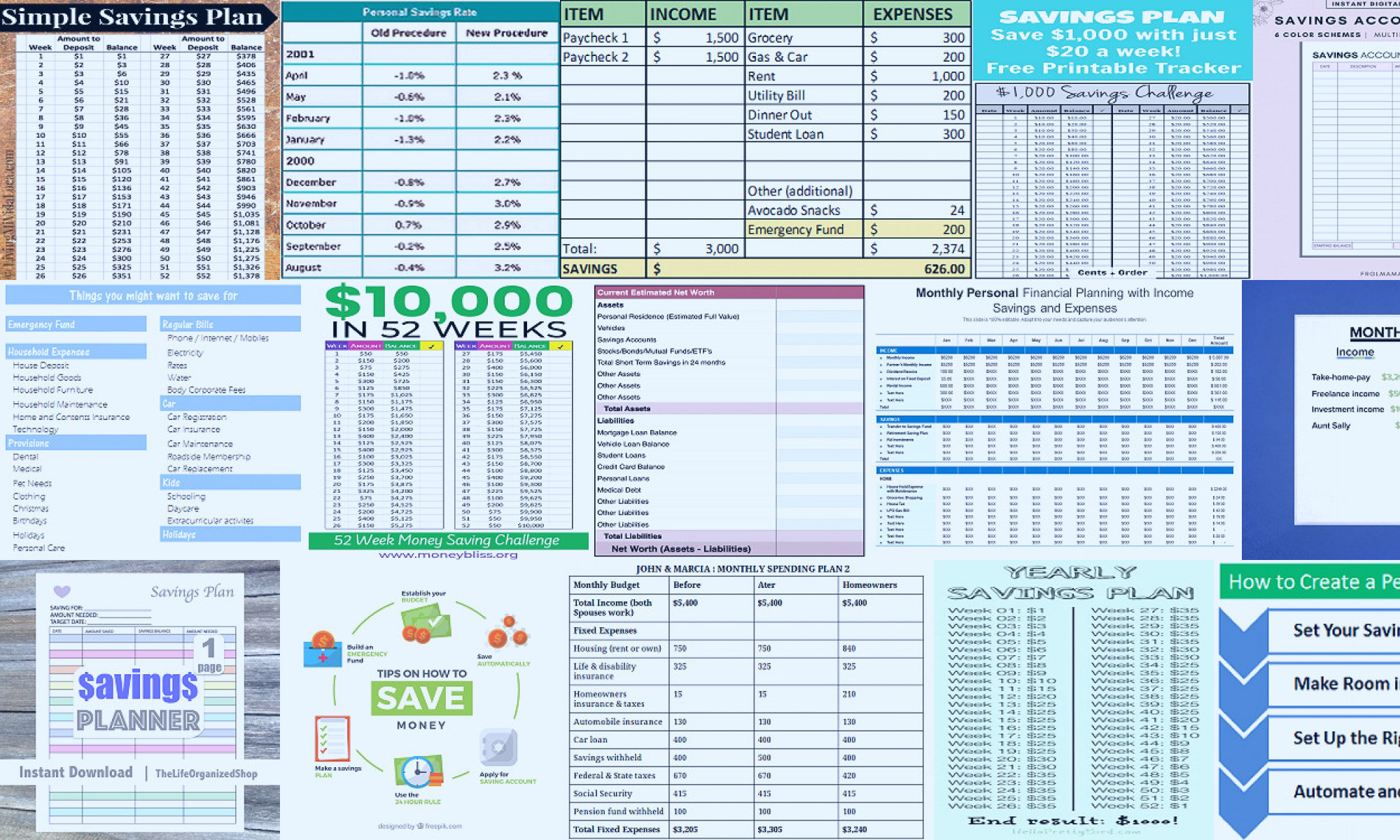

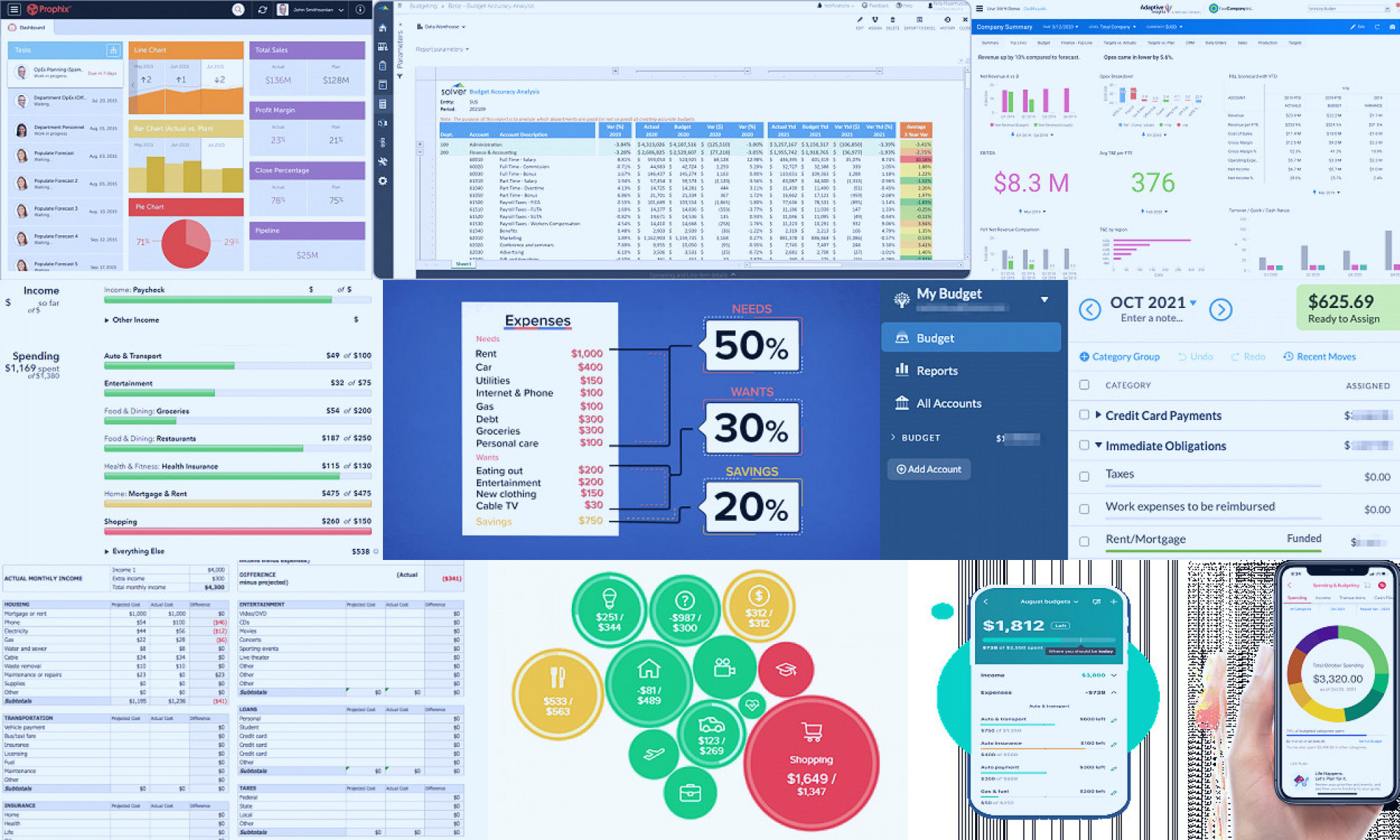

Personal Savings Plan

A personal savings plan is a strategic financial program that allows individuals to systematically accumulate wealth over a specific period. It involves setting aside a portion of one's income regularly into a savings account or investment portfolio. This plan is designed to help meet various financial goals, such as retirement, education, or buying a house. It encourages disciplined saving, promotes financial security, and paves the way towards financial independence.Visit site