Guard Your Finances: Why Overdraft Protection is a Must-Have Safety Net

Overdraft Protection is a financial service provided by banks to their account holders. It acts as a safety net for those moments when your checking account balance falls below zero. Instead of having your debit card declined or a check bounce, the bank will cover the shortfall, allowing the transaction to proceed. This service can be a financial lifesaver, preventing embarrassment, additional merchant fees, and negative impacts on your credit history. However, it's important to remember that overdraft protection often comes with its own fees, so it should be used wisely and sparingly.

| Service | Overdraft Protection |

| Provider | Bank Name |

| Type of Service | Financial/Banking |

| Purpose | Preventing Overdraft Fees |

| Availability | For Checking Account Holders |

| Usage Limit | Depends on Account and Bank Policy |

| Fees | Vary by Bank |

| Activation | Manual or Automatic |

| Linked Account | Yes/No |

| Coverage | Full or Partial Overdraft |

| Overdraft Transfer Fee | Varies by Bank |

| Minimum Transfer Amount | Varies by Bank |

| Interest Charged | Yes/No, Varies by Bank |

| Regulation | FDIC or other relevant authority |

| Eligibility | Based on Credit Score and Banking History |

| Application | Online/In-person |

| Customer Service | Available 24/7 or During Business Hours |

| Terms and Conditions | Available on Bank's Website/App |

| Cancellation Policy | Available on Bank's Website/App |

| Note | Overdraft protection may lead to unwanted debt if not managed properly. Always understand the terms and conditions before opting in. |

Understanding Overdraft Protection

Overdraft protection is a service offered by banks that allows you to continue making transactions even when your account balance falls below zero. This can be a helpful safety net, preventing your debit card from being declined or checks from bouncing due to insufficient funds. Read more

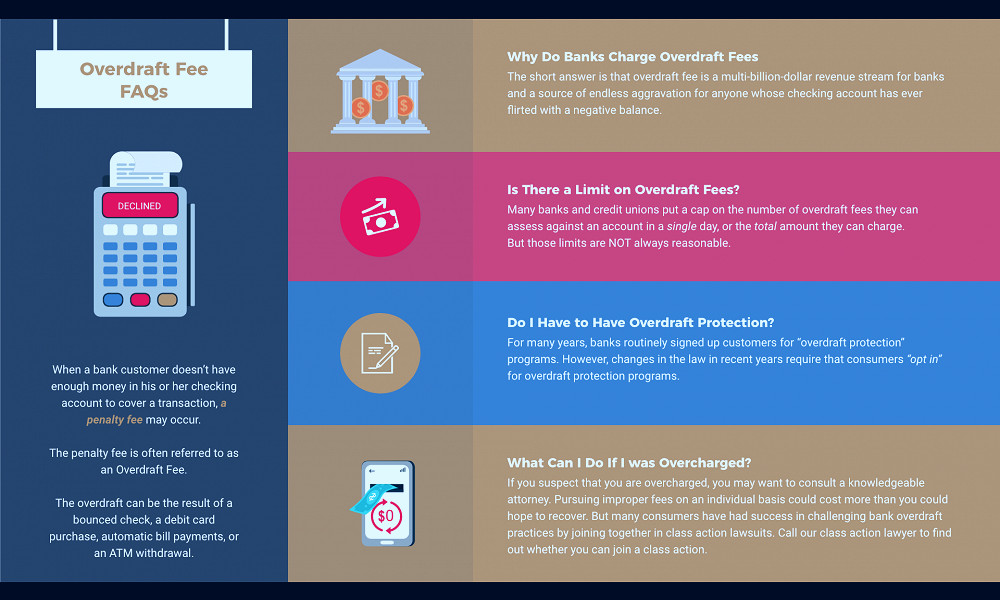

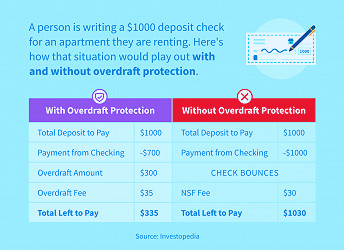

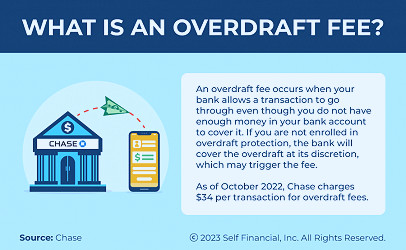

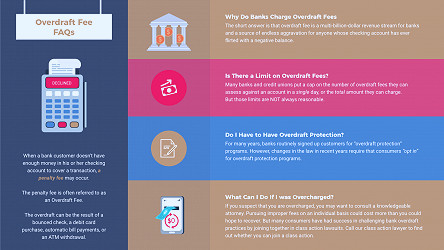

Cost of Overdraft Protection

While overdraft protection can be a lifeline in emergencies, it’s important to understand the costs associated with it. Most banks charge an overdraft fee every time this service is used. These fees can quickly add up, turning a small overdraft into a significant expense. Read more

Linking Accounts for Overdraft Protection

One popular method of overdraft protection involves linking a checking account to a savings account or credit card. If you overdraw your checking account, funds will be automatically transferred from your linked account to cover the shortfall, often for a lower fee than traditional overdraft coverage. Read more

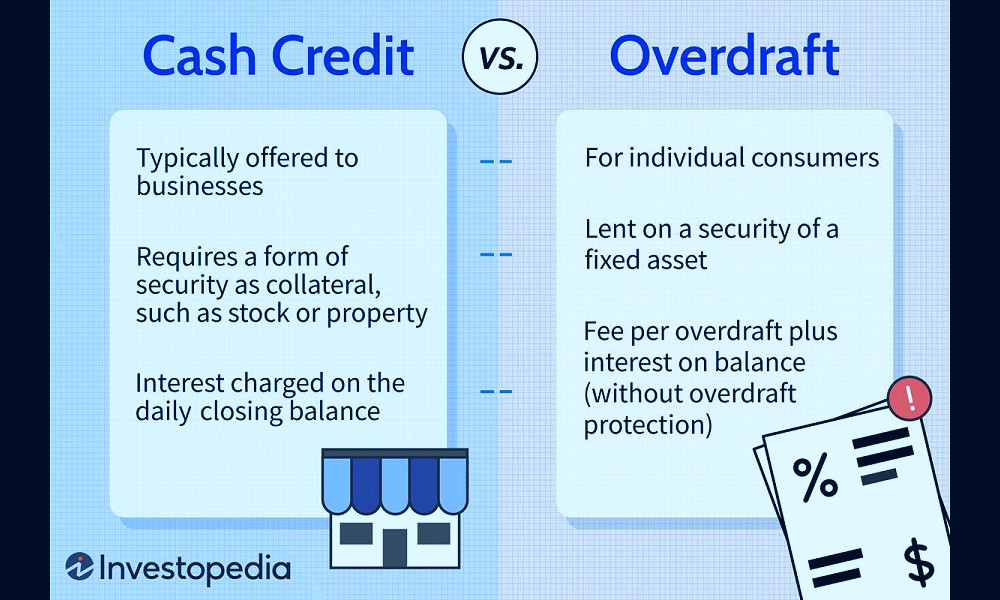

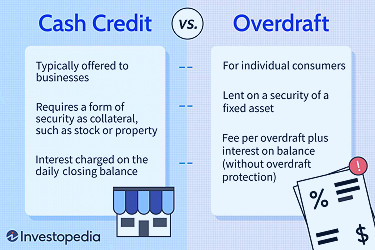

Overdraft Lines of Credit

Some banks offer an overdraft line of credit. Like a credit card, this line of credit can be drawn upon when your checking account balance is insufficient. Interest is charged on the overdraft balance, but this may be less expensive than paying multiple overdraft fees. Read more

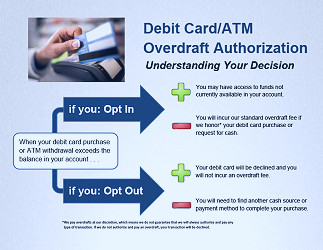

Opting In or Out

Overdraft protection is not automatic. In fact, federal law requires banks to obtain your consent before providing standard overdraft coverage for ATM withdrawals and debit card purchases. You can choose to opt in or out of this service at any time. Read more

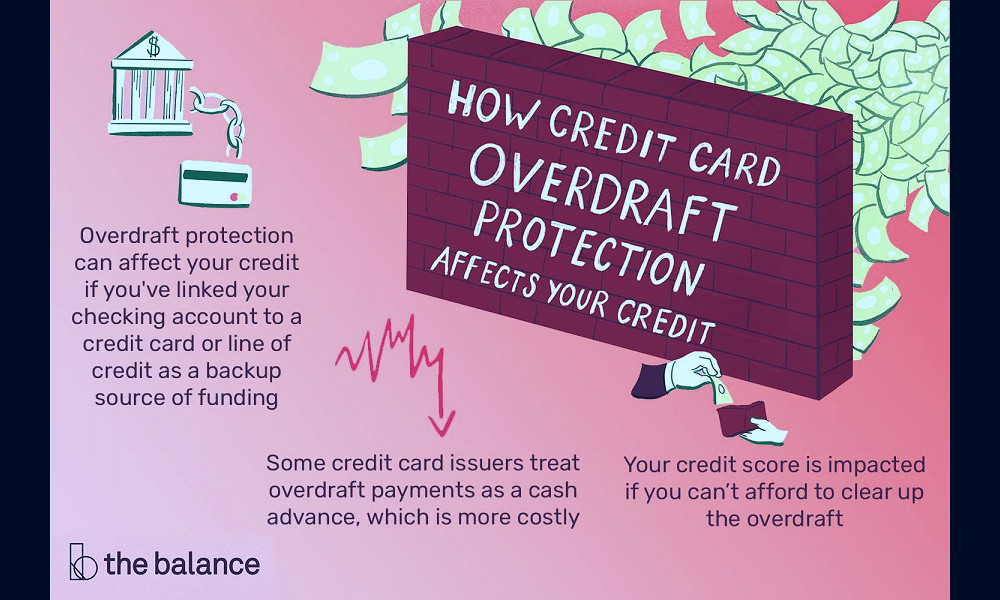

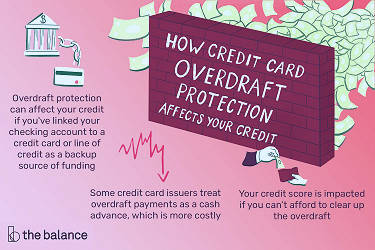

Impact on Credit Score

Overdraft protection services that involve credit (like a linked credit card or overdraft line of credit) could potentially impact your credit score if not managed correctly. Consistently maxing out your available credit or making late payments can lower your credit score. Read more

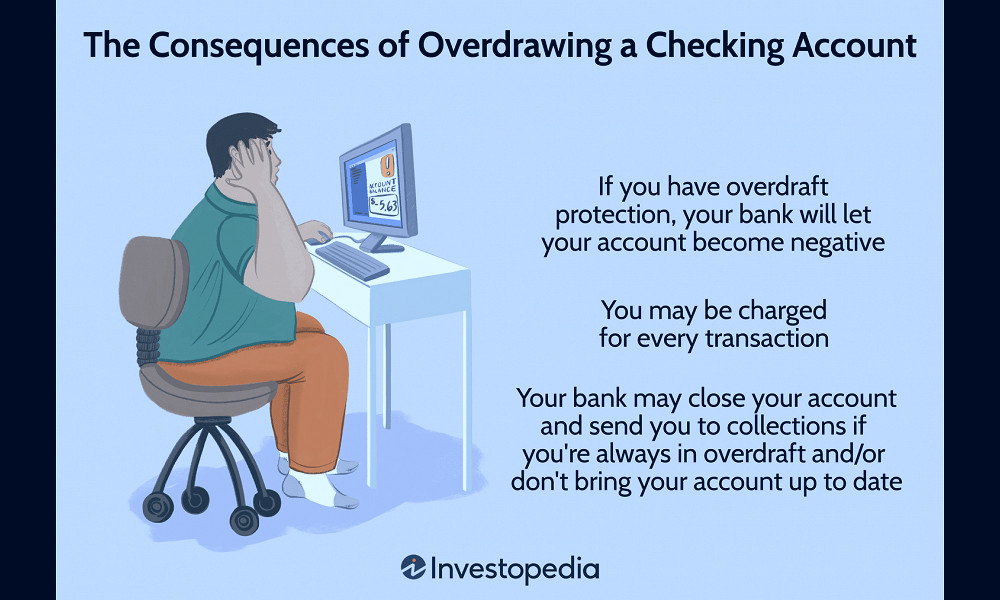

Overdraft Protection and Financial Management

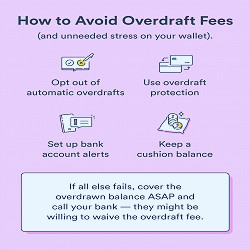

While overdraft protection can provide a safety net, it’s not a substitute for good financial management. Regularly overdrawing your account can lead to high fees and create a cycle of debt. It’s important to monitor your account balance closely and avoid unnecessary overdrafts. Read more

Comparing Overdraft Protection Options

When choosing overdraft protection, it's crucial to compare different options. Look closely at the fees, terms and conditions of each option. Consider how likely you are to overdraw your account and how much that would cost with each type of overdraft protection. Read more

Alternatives to Overdraft Protection

If you're concerned about the cost of overdraft protection, there are alternatives. For instance, you can set up balance alerts to notify you when your account balance is low. You could also consider a bank that doesn't charge overdraft fees, or a checking account that doesn't allow overdrafts. Read more

Making an Informed Decision

Ultimately, the choice to use overdraft protection is a personal one. It's essential to understand the costs and benefits and make an informed decision based on your financial habits and needs. Remember, overdraft protection is a tool to help manage your finances, not a solution for chronic financial shortfalls. Read more

Facts

1. The Savior in Financial Emergencies: Overdraft ProtectionEver found yourself in a financial jam, where your bank account balance is on the brink of zero? That's where overdraft protection swoops in like a superhero. It's a service provided by banks that covers transactions when you don't have enough money in your account. No more embarrassing moments at the checkout line, no more declined transactions, just smooth financial sailing.

2. Overdraft Protection: The Safety Net for Your Checking Account

Imagine your checking account as a high-wire artist, performing without a safety net. Scary, right? Overdraft protection is that safety net. It covers the financial gap when your account balance can't meet your expenses. It's like having a financial guardian angel that keeps you from falling into the abyss of insufficient funds.

3. The Magic of Linking Accounts: Overdraft Protection's Secret Weapon

Here's a little secret about how overdraft protection works. It links your checking account to another account - it could be a savings account, credit card, or line of credit. So, when your checking account balance can't cover a transaction, funds are automatically transferred from the linked account. It's like a magical money transfer that keeps your financial reputation intact.

4. Overdraft Protection: The Shield Against High Fees

One of the biggest perks of overdraft protection is its ability to shield you from high fees. Banks often charge hefty fees for each transaction that overdraws your account. With overdraft protection in place, these fees can be significantly reduced or even eliminated. It's like having a financial shield that guards your hard-earned money.

5. Overdraft Protection: A Lifeline, Not A Lifestyle

While overdraft protection is a great tool to prevent financial mishaps, it's important to remember that it's a lifeline, not a lifestyle. It's designed to cover occasional shortfalls, not to support chronic overspending. So, use it wisely, respect your financial boundaries, and let overdraft protection be your safety net, not your crutch.

6. Understanding The Costs: Overdraft Protection Fees

Yes, overdraft protection is a great service, but it's not always free. Banks may charge a fee for the service, which may be a fixed amount per transfer or a percentage of the overdraft amount. It's important to understand the costs before signing up, so you can weigh the benefits against the fees.

7. The Invisible Benefit: Overdraft Protection and Your Credit Score

Did you know that overdraft protection can help protect your credit score? By preventing your account from going negative, it can help you avoid bounced checks and other negative marks on your banking history. A healthy credit score is vital for securing loans and credit cards, so this invisible benefit of overdraft protection can't be overlooked.

8. Overdraft Protection: Not A One-Size-Fits-All Solution

Just like clothes, overdraft protection isn't a one-size-fits-all solution. It might be a great tool for some, but not necessary for others. It all depends on your financial habits, your spending discipline, and your personal comfort with risk. So, consider your unique financial situation before deciding if overdraft protection is right for you.

9. The Fine Print: Understanding Overdraft Protection Policies

Before you sign up for overdraft protection, it's important to read the fine print. Understand the terms and conditions, the fees, and the limits. Know when the service will be triggered, how much will be transferred, and how often. Knowledge is power, and understanding the policy can help you make the most of this valuable service.

10. Overdraft Protection: The Final Verdict

Overdraft protection can be a financial lifesaver, shielding you from high fees, embarrassing declines, and damage to your credit score. But it's important to use it wisely, understand the costs, and read the fine print. As with all financial tools, the key to success is knowledge, discipline, and a healthy respect for your financial boundaries.

Read more

What Does Overdraft Protection Mean for Your Credit?

What Does Overdraft Protection Mean for Your Credit? What Is Overdraft Protection and Is It Worth It? | Lexington Law

What Is Overdraft Protection and Is It Worth It? | Lexington Law Overdraft Explained: Fees, Protection, and Types

Overdraft Explained: Fees, Protection, and Types Overdraft Protection: What Your Bank Doesn't Want You to Know

Overdraft Protection: What Your Bank Doesn't Want You to Know Benefits of Overdraft Protection - The People's Federal Credit Union

Benefits of Overdraft Protection - The People's Federal Credit Union Overdraft Protection - Meaning, Types, Fees, Example, What is it?

Overdraft Protection - Meaning, Types, Fees, Example, What is it? Do You Need Overdraft Protection? - Ramsey

Do You Need Overdraft Protection? - Ramsey Cash Credit vs. Overdraft: What's the Difference?

Cash Credit vs. Overdraft: What's the Difference? What Is Overdraft Protection?

What Is Overdraft Protection? Overdraft Protection - CreditRepair.com

Overdraft Protection - CreditRepair.com Overdraft Protection - GenFed Credit Union

Overdraft Protection - GenFed Credit Union What Are Overdraft Fees? A Simplified Guide for 2023 - Chime

What Are Overdraft Fees? A Simplified Guide for 2023 - Chime Overdraft Protection: What Does it Mean + Should You Get It?

Overdraft Protection: What Does it Mean + Should You Get It? What is overdraft protection? Definition and meaning - Market Business News

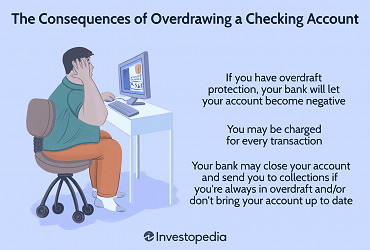

What is overdraft protection? Definition and meaning - Market Business News The Consequences of Overdrawing a Checking Account

The Consequences of Overdrawing a Checking Account How to Get Your Chase Overdraft Fees Waived - Self. Credit Builder.

How to Get Your Chase Overdraft Fees Waived - Self. Credit Builder. Why Do Banks Charge Overdraft Fees? | Franklin D. Azar & Associates, P.C.

Why Do Banks Charge Overdraft Fees? | Franklin D. Azar & Associates, P.C. Overdraft Protection | Wellby

Overdraft Protection | Wellby Overdraft Protection Services in York, PA | Traditions Bank

Overdraft Protection Services in York, PA | Traditions Bank Overdraft Protection - CreditRepair.com

Overdraft Protection - CreditRepair.com