Unlock Your Financial Freedom: Choose the Best Online Checking Account Today!

An open online checking account is a digital banking service that allows you to manage your money with ease and convenience. From the comfort of your home or anywhere in the world, you can deposit checks, pay bills, transfer funds, and monitor your transactions. It offers fast, secure, and seamless access to your finances 24/7. No need for physical visits to the bank or waiting in long lines. With an open online checking account, banking is just a click away.

| Bank Name | |

| Account Type | Checking |

| Minimum Initial Deposit | |

| Monthly Service Fee | |

| Annual Percentage Yield (APY) | |

| ATM Access | |

| Online Banking | |

| Mobile Banking | |

| Direct Deposit feature | |

| Overdraft Protection | |

| Customer Service | |

| FDIC Insured | |

| Additional Features |

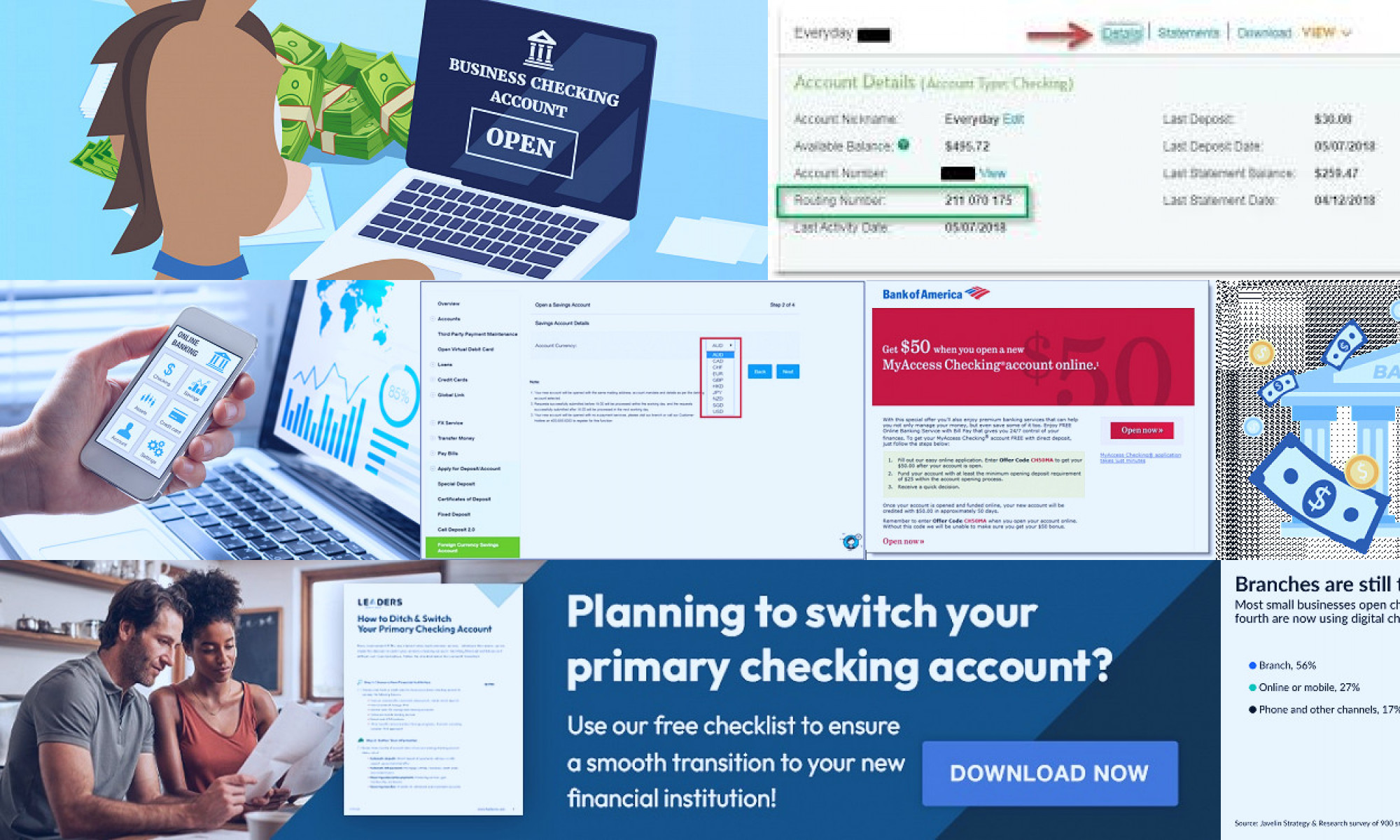

Convenience of Online Banking

One of the major advantages of an online checking account is the convenience it offers. You can make transactions, pay bills, and manage your account from anywhere, at any time. The freedom and flexibility that comes with online banking make it a highly sought-after service in today's digital age. Read more

Digital Security

Banks understand the importance of keeping your personal and financial data secure. They employ multiple layers of security measures such as encryption, fraud monitoring, and two-factor authentication to safeguard your online checking account. The security protocols are always up to date with the latest technology, ensuring your online transactions are safe and secure. Read more

Lower Fees

Online checking accounts typically have lower fees than traditional bank accounts. They often come with fewer service charges, lower overdraft fees, and no minimum balance requirements. This cost-effectiveness is a significant advantage for those looking to optimize their financial management. Read more

High Accessibility

Unlike traditional banks that operate within specific hours, online checking accounts are accessible 24/7. Whether it's the middle of the night or during a holiday, you can always access your account, check your balance, and make transactions. Read more

Quick and Efficient Transactions

Online checking accounts allow for fast and efficient transactions. Whether it's transferring money to another account, paying bills, or making deposits, all these tasks can be done within minutes through your online account. Read more

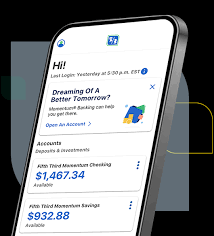

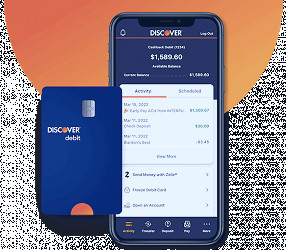

Mobile Banking

Most online banks offer a mobile app, allowing you to manage your account from your smartphone or tablet. This feature makes banking even more convenient as you can access your account while on the go. Read more

Eco-Friendly

By opting for an online checking account, you're also making an eco-friendly choice. Online banking reduces the need for paper statements, checks, and other physical banking materials, thus contributing to environmental conservation. Read more

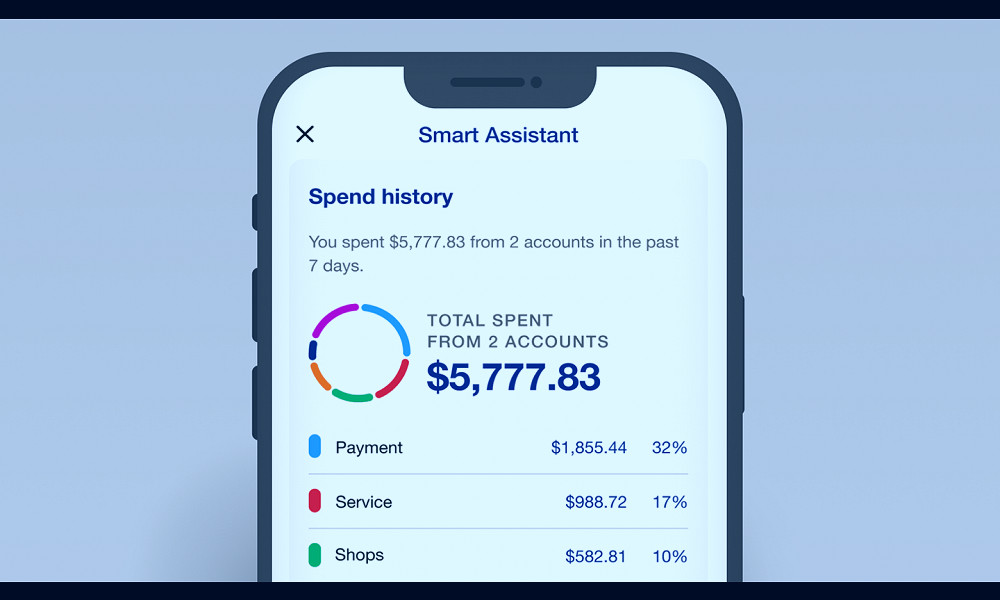

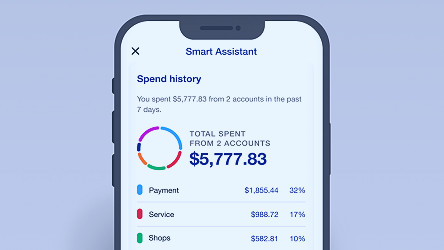

Easy Budgeting and Tracking

Online checking accounts make it easier to track your spending and manage your budget. Most online banks provide tools and insights that help you understand your spending habits, making it easier to plan and save. Read more

High-Interest Rates

Some online checking accounts offer higher interest rates than traditional banks. This means your money will grow faster, making online banking a more profitable option. Read more

Customer Support

Despite being an online service, banks ensure you have access to customer support when you need it. Whether through email, live chat, or phone, help is available to resolve any issues or answer any questions you may have about your account. Read more

Facts

1. The Comfort of Your Couch: With an online checking account, the bank is always open. No more rushing to the bank before it closes or waiting in long lines. You can access your account anytime, anywhere, all from the comfort of your couch.2. Security at its Finest: Online banking uses advanced encryption techniques to secure your data. Whether you're checking your balance or making a transaction, you can rest assured that your information is safe and secure.

3. Go Green: By banking online, you are contributing to the environment. You'll reduce your carbon footprint by eliminating paper waste from bank statements, receipts, and checks.

4. No More Paper Checks: With an online checking account, you can pay your bills directly from your account. This means no more writing checks or worrying about them getting lost in the mail. It’s a more efficient and secure way to pay.

5. Say Goodbye to Minimum Balances: Many online checking accounts have no minimum balance requirements. This means you can keep as much or as little in your account as you want without worrying about fees.

6. Your Money, Your Way: With online banking, you can easily customize your banking experience. Set up alerts for low balances, customize your dashboard, and manage your money the way you want to.

7. 24/7 Customer Support: Most online banks offer 24/7 customer support. Whether it's a simple question or a complex issue, help is just a call or click away.

8. Deposit Checks with a Snap: With an online checking account, you can deposit checks with just a snap. Simply take a picture of the check with your smartphone, and it's deposited into your account. It's fast, easy, and convenient.

9. Save on Fees: Online banks typically have lower fees than traditional banks. This is because they don't have the overhead costs associated with physical locations. This savings is often passed onto the customer in the form of lower fees.

10. Track Your Spending Habits: Online banking allows you to easily track your spending habits. You can see where your money is going and make smarter financial decisions. Plus, many online banks offer tools and resources to help you manage your money better.

Read more

Online checking account | Open a checking account | U.S. Bank

Online checking account | Open a checking account | U.S. Bank Checking Account - No Fees with Cashback Debit | Discover

Checking Account - No Fees with Cashback Debit | Discover Open Your Checking Account Online | IncredibleBank

Open Your Checking Account Online | IncredibleBank How to Open Your NBT Bank Account Online | NBT Bank

How to Open Your NBT Bank Account Online | NBT Bank How To Open a Checking Account Online | The Motley Fool

How To Open a Checking Account Online | The Motley Fool Open Your Account Now! - Northwest Bank

Open Your Account Now! - Northwest Bank Can you open a checking account online?

Can you open a checking account online? Open a Checking Account | Apply Online | Fifth Third Bank

Open a Checking Account | Apply Online | Fifth Third Bank 2023's Best Banks for Free Checking Accounts | Best Free Checking Accounts | Free Bank Account | What Banks Offer Free Checking Accounts?

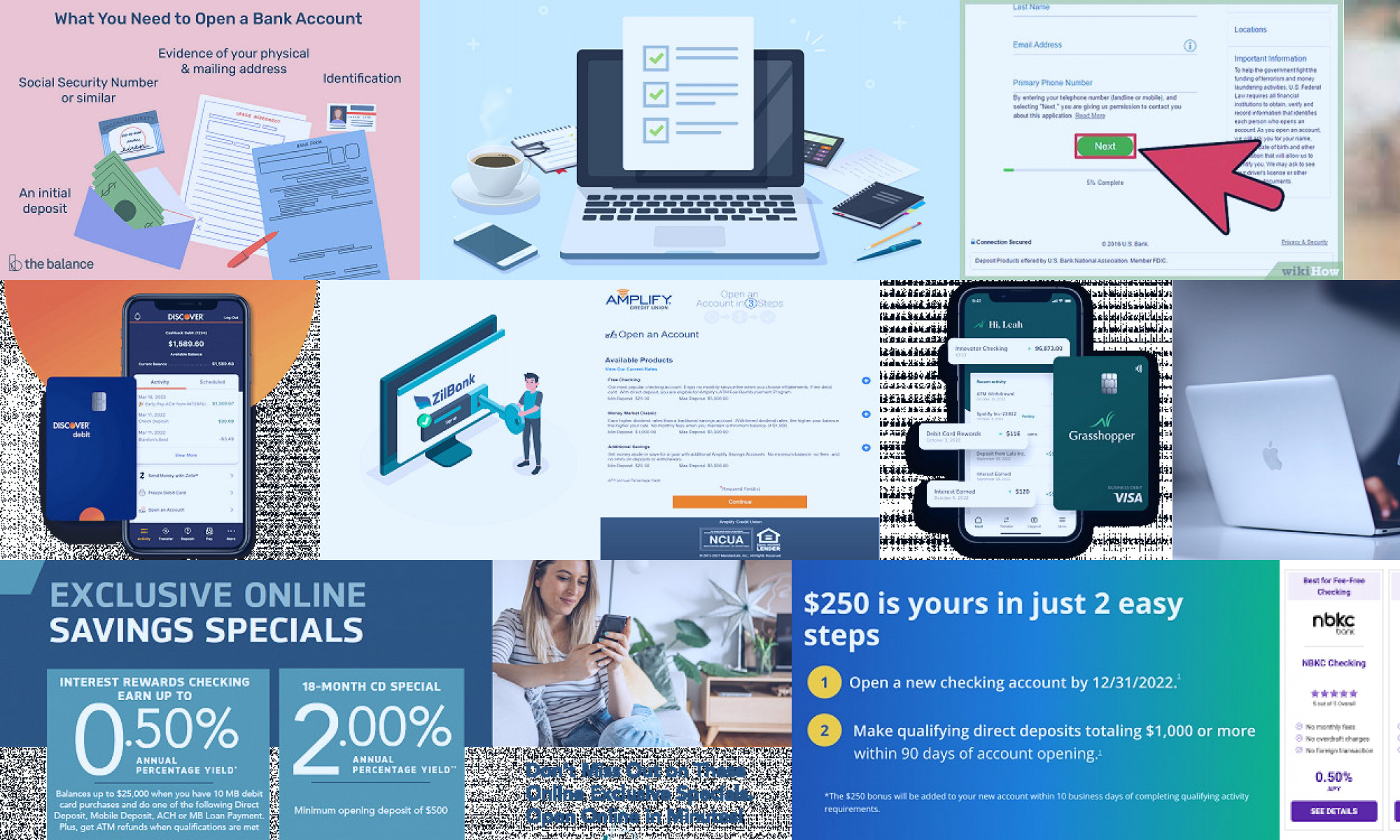

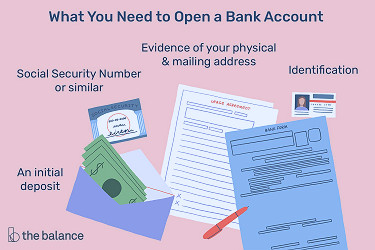

2023's Best Banks for Free Checking Accounts | Best Free Checking Accounts | Free Bank Account | What Banks Offer Free Checking Accounts? How To Open a Bank Account and What You Need To Do

How To Open a Bank Account and What You Need To Do How to open your checking account online | Union Bank & Trust

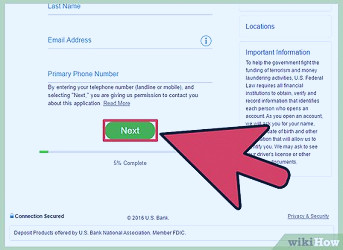

How to open your checking account online | Union Bank & Trust How to Open a Checking Account Online (with Pictures) - wikiHow Life

How to Open a Checking Account Online (with Pictures) - wikiHow Life Open a Personal Checking Account Online | Citizens

Open a Personal Checking Account Online | Citizens Checking Account - No Fees with Cashback Debit | Discover

Checking Account - No Fees with Cashback Debit | Discover Open Online Checking Account Instantly With No Hidden Fee

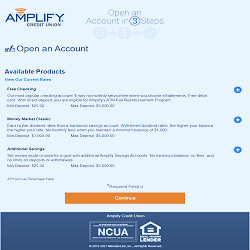

Open Online Checking Account Instantly With No Hidden Fee How To Open a New Account - Amplify Credit Union

How To Open a New Account - Amplify Credit Union Open a Small Business Checking Account Online | Grasshopper

Open a Small Business Checking Account Online | Grasshopper How To Open An Online Checking Account In 6 Easy Steps - Masterworks

How To Open An Online Checking Account In 6 Easy Steps - Masterworks Digital Account Opening | The Middlefield Banking Company

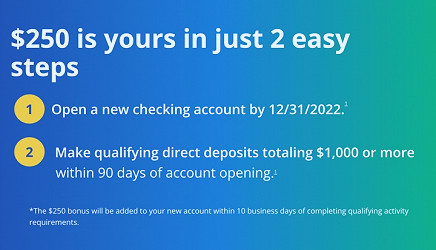

Digital Account Opening | The Middlefield Banking Company Fifth Third Bank $250 New Checking Account Bonus w/ Direct Deposit (Expired) — My Money Blog

Fifth Third Bank $250 New Checking Account Bonus w/ Direct Deposit (Expired) — My Money Blog