Seize Control of Your Finances: The Ultimate Guide to Opening an Online Checking Account

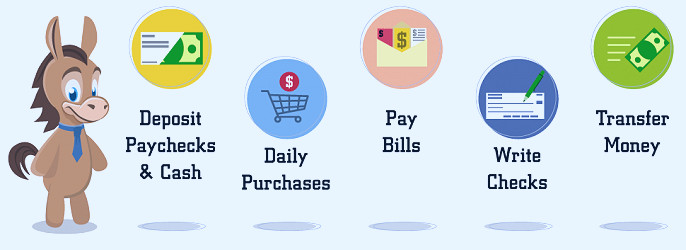

An online checking account is a virtual hub for your money, where you can transfer funds, pay bills, and manage your finances with a few clicks. It's a simple, secure, and convenient way to keep track of your income and expenses without the need for physical banking. Offering features like mobile check deposit, direct deposit, online bill payment, and 24/7 account access, it's like having a bank at your fingertips. Say goodbye to the hassle of traditional banking and embrace the ease of online checking accounts.

| Bank Name | Unknown |

| Type of Account | Checking Account |

| Minimum Opening Deposit | Varies |

| Monthly Service Fee | Varies |

| Interest Rate | Varies |

| ATM Access | Varies |

| Online Banking | Available |

| Mobile Banking | Available |

| Overdraft Protection | Varies |

| Paper Checks | Varies |

| Debit Card | Available |

| Direct Deposit | Available |

| Customer Support | Available |

| FDIC Insured | Yes |

| Account Closure Fee | Varies |

| Daily ATM Withdrawal Limit | Varies |

| Daily Purchase Limit | Varies |

| Availability | Online |

| Eligibility | Age, residential status, ID proof, Social Security Number (SSN) |

| Application Process Time | Varies |

| Additional Features | Varies (e.g., rewards program, cash back, etc.) |

Digital Convenience

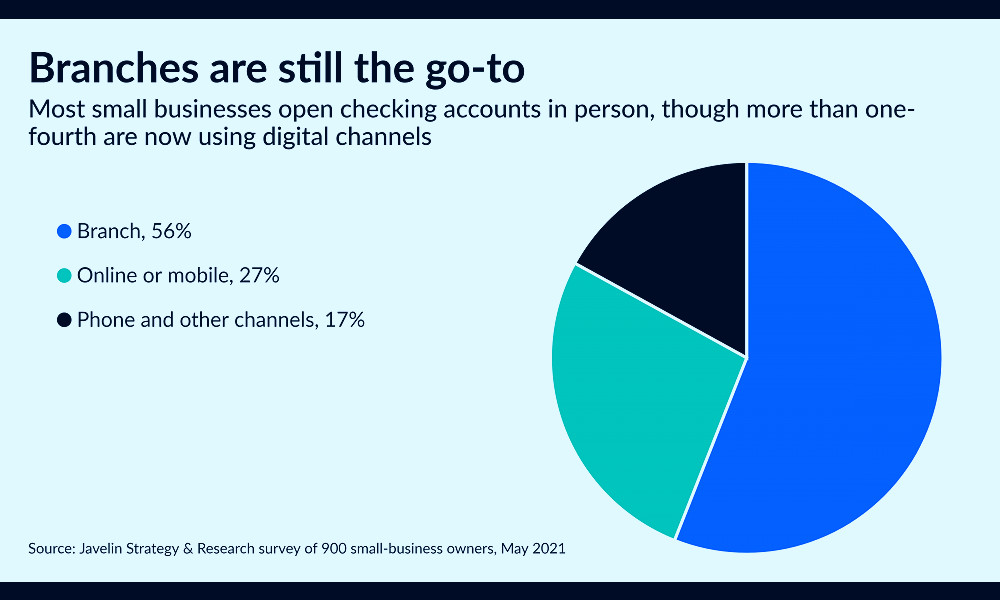

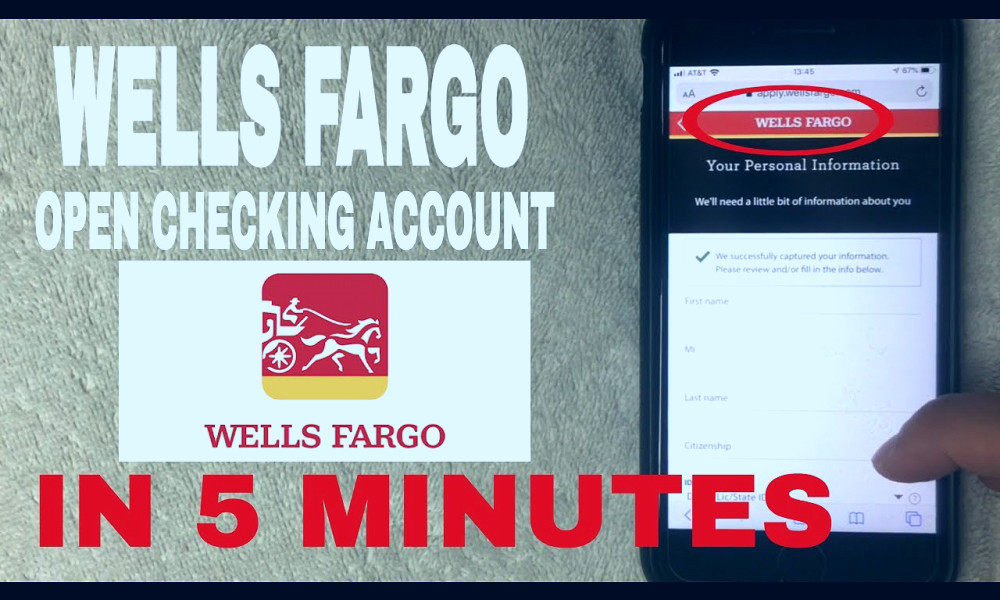

Opening a checking account online provides you with the utmost convenience. It cuts out the need to physically visit a bank branch and wait in line. All you need is a device with internet access and you can open your account from anywhere, at any time. Read more

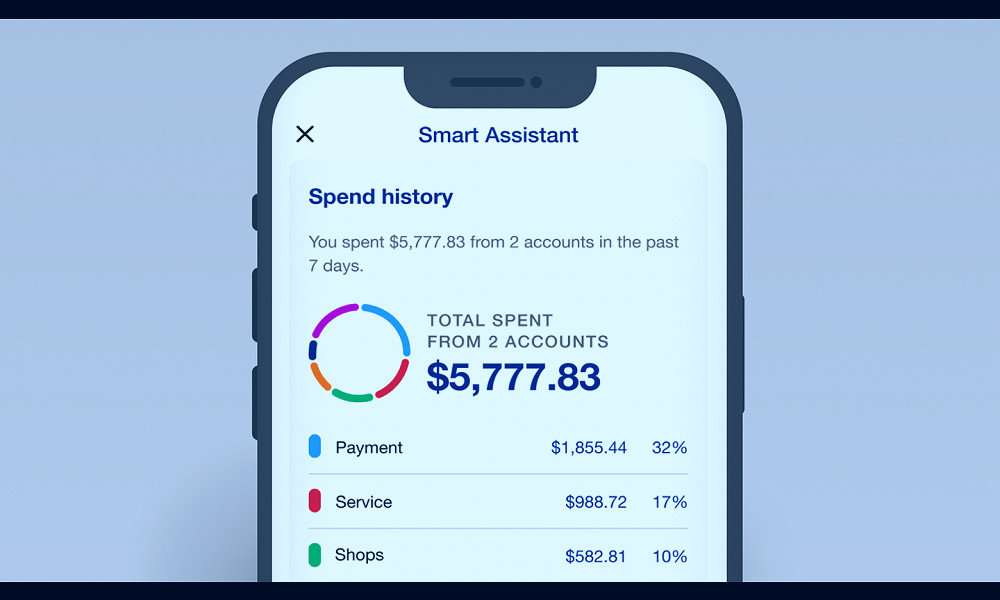

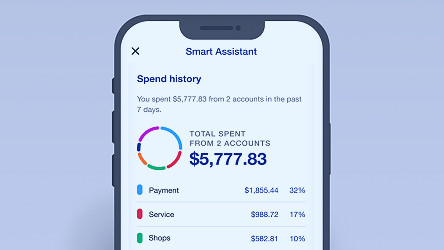

Easy Account Management

Online checking accounts offer easy account management. From tracking your balance, depositing checks, paying bills, to transferring funds, everything can be done with a few clicks or taps, providing a seamless banking experience. Read more

24/7 Access

With an online checking account, banking hours are a thing of the past. You have 24/7 access to your account, allowing you to manage your finances whenever you want. This flexibility is a significant advantage for those with busy schedules. Read more

High-Level Security

Banks offering online services prioritize the security of their customers' accounts. With features like encryption, secure logins, fraud monitoring, and two-factor authentication, your online checking account is well-protected against potential threats. Read more

Real-Time Notifications

Online checking accounts offer real-time notifications for any account activity. Whether it's a deposit, withdrawal, or payment, you'll receive an instant alert, helping you keep a close eye on your transactions and detect any fraudulent activity. Read more

Minimal or No Fees

Many online checking accounts come with minimal or no fees. Unlike traditional banks, online banks do not have to maintain physical branches, allowing them to pass on the cost savings to customers in the form of lower fees. Read more

Higher Interest Rates

Some online banks offer higher interest rates on checking accounts compared to traditional banks. This means your money is working harder for you, even when it's just sitting in your account. Read more

Eco-Friendly

Opening and managing a checking account online is a green choice. It reduces the need for paper statements, checks, and other physical banking materials, thus helping to save trees and reduce waste. Read more

Wide Range of Features

Online checking accounts often come with a wide range of features, such as mobile check deposit, bill pay, money transfer services, and more. These features can make managing your finances easier and more efficient. Read more

Customer Support

Most online banks offer robust customer support services. Whether you need help opening an account, have a question, or encounter an issue, help is usually just a phone call, email, or live chat away. This ensures that you always have assistance when you need it. Read more

Facts

1. Instant Access: With an online checking account, you have instant access to your money. You can check your balance, pay bills, transfer money, and even deposit checks with just a few clicks. No more waiting in long lines at the bank or searching for an ATM.2. Money Management: Online checking accounts make it easy to manage your money. With features like automatic bill pay and budgeting tools, you can keep track of your spending and save more effectively. Plus, you can set up alerts to let you know when your balance is low or a payment is due.

3. Convenience: With an online checking account, you can do your banking anytime, anywhere. Whether you're at home, at work, or on the go, all you need is an internet connection. No more rushing to the bank during your lunch break or trying to fit it into your busy schedule.

4. Safety: Online banking is incredibly safe. Banks use high-level encryption to protect your information, and many offer two-factor authentication for added security. Plus, if you lose your debit card, you can instantly lock it from your online account.

5. Eco-friendly: Online banking is much more environmentally friendly than traditional banking. You can opt for e-statements instead of paper ones, helping to cut down on waste. Plus, without the need for physical branches, online banking reduces energy consumption and carbon emissions.

6. High-Interest Rates: Many online checking accounts offer high-interest rates, allowing you to earn more on your money. Some even offer cash back or rewards on purchases, giving you even more bang for your buck.

7. Low Fees: Online banks don't have the overhead of physical branches, which means they can pass the savings on to you. Many online checking accounts have low or no fees, including no monthly maintenance fees, no minimum balance requirements, and even free ATM use.

8. Innovative Features: Online banks are at the forefront of banking technology. From mobile check deposit to voice-activated banking, you can take advantage of the latest innovations with an online checking account.

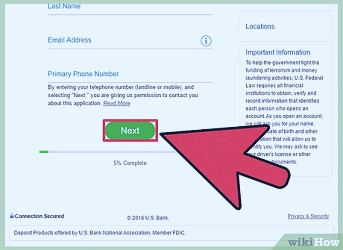

9. Easy Setup: Setting up an online checking account is a breeze. All you need is a few minutes and some basic information. You can open an account from your computer or even your smartphone.

10. Personalized Service: Even though you're banking online, you still get personalized service. Most online banks have customer service representatives available 24/7. Plus, many have robust online communities and educational resources to help you make the most of your account.

Read more

Online checking account | Open a checking account | U.S. Bank

Online checking account | Open a checking account | U.S. Bank How to Open Your NBT Bank Account Online | NBT Bank

How to Open Your NBT Bank Account Online | NBT Bank How To Open Bank Of America Account Online In 3 Step - Guide

How To Open Bank Of America Account Online In 3 Step - Guide Open Your Checking Account Online | IncredibleBank

Open Your Checking Account Online | IncredibleBank 2023's Best Banks for Free Checking Accounts | Best Free Checking Accounts | Free Bank Account | What Banks Offer Free Checking Accounts?

2023's Best Banks for Free Checking Accounts | Best Free Checking Accounts | Free Bank Account | What Banks Offer Free Checking Accounts? How To Open a Checking Account Online | The Motley Fool

How To Open a Checking Account Online | The Motley Fool Can you open a checking account online?

Can you open a checking account online? Checking Account - No Fees with Cashback Debit | Discover

Checking Account - No Fees with Cashback Debit | Discover Open Your Account Now! - Northwest Bank

Open Your Account Now! - Northwest Bank How to open your checking account online | Union Bank & Trust

How to open your checking account online | Union Bank & Trust Open a Personal Checking Account Online | Citizens

Open a Personal Checking Account Online | Citizens Open a Checking Account | Apply Online | Fifth Third Bank

Open a Checking Account | Apply Online | Fifth Third Bank These Are the Easiest Bank Accounts to Open Online in the US

These Are the Easiest Bank Accounts to Open Online in the US How to Open a Checking Account Online (with Pictures) - wikiHow Life

How to Open a Checking Account Online (with Pictures) - wikiHow Life What Do I Need to Open a Checking Account?

What Do I Need to Open a Checking Account? Open Online Checking Account Instantly With No Hidden Fee

Open Online Checking Account Instantly With No Hidden Fee Open A Checking Account Online In Minutes | TD Bank Checking Accounts

Open A Checking Account Online In Minutes | TD Bank Checking Accounts Checking Account - No Fees with Cashback Debit | Discover

Checking Account - No Fees with Cashback Debit | Discover Open Business Checking Account Online For All Businesses

Open Business Checking Account Online For All Businesses 6 Best Places to Open Business Checking Account Online

6 Best Places to Open Business Checking Account Online