Unlocking Your Home's Wealth: A Comprehensive Guide to Home Equity Loans

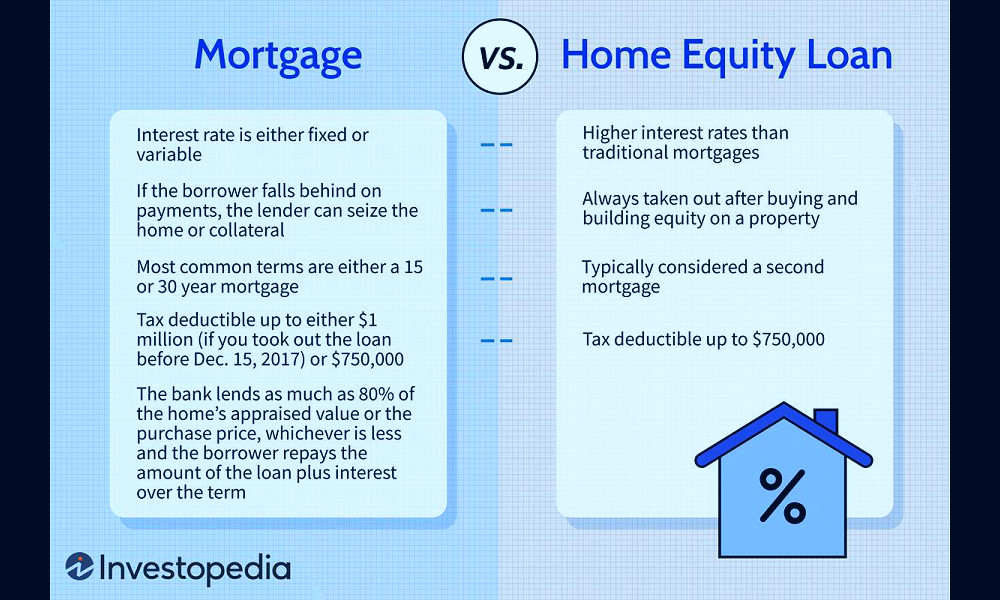

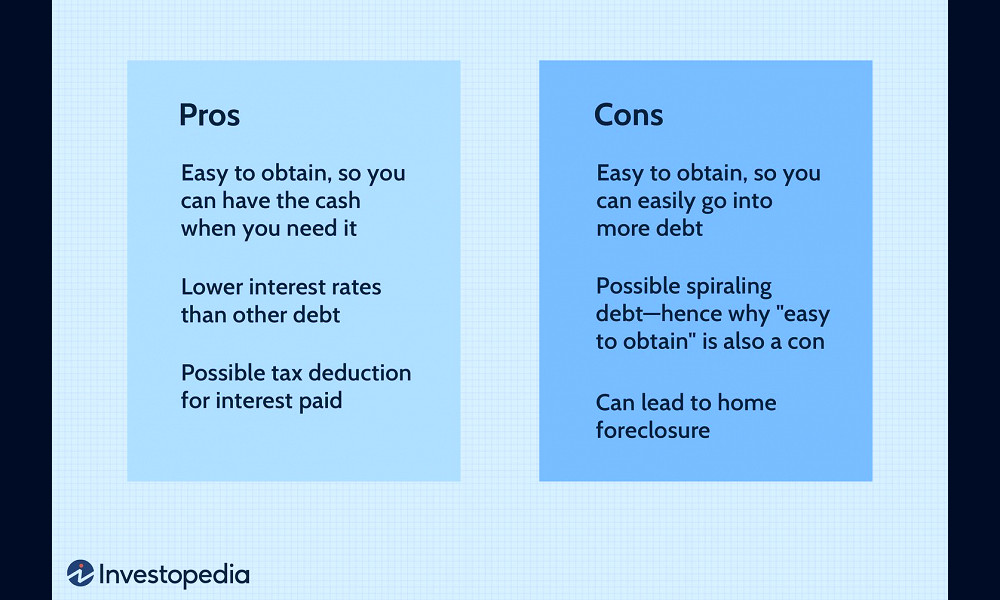

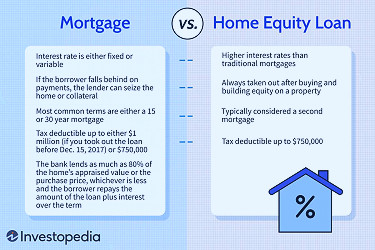

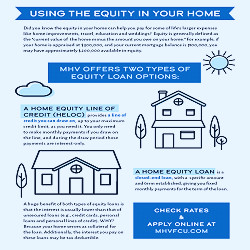

Home Equity Loans are financial products that allow homeowners to borrow against the equity built up in their homes. They can be a powerful tool for homeowners looking to pay off high-interest debt, fund home improvements, or finance major expenses. These loans offer potential tax benefits and typically come with lower interest rates compared to other types of loans. The borrowed amount is determined by the appraised value of the house and the amount owed on the mortgage. However, they do come with a risk - if you can't repay the loan, you could lose your home. So, it's crucial to borrow responsibly.

| Loan Type | Home Equity Loan |

| Loan Amount | Varies |

| Interest Rate | Varies, Fixed or Adjustable |

| Loan Term | Varies, typically 5-30 years |

| Minimum Credit Score | Varies, typically 620 or above |

| Up to 85% | |

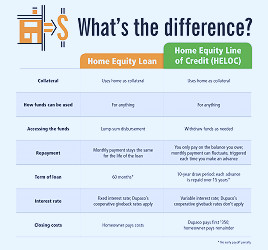

| Repayment Options | Monthly installments of principal and interest |

| Loan Features | Second mortgage, Uses home equity as collateral, Possibility to deduct interest on taxes |

| Use of Funds | Home improvements, Debt consolidation, Education, Major purchases |

| Eligibility | Proof of income, Proof of homeownership, Sufficient equity in the home |

| Fees | Closing costs, Early payoff penalty, Annual fees |

| Lender | Various banks, credit unions, online lenders |

| Approval Time | Varies by lender, typically a few days to a few weeks |

| Disbursement of Funds | Lump sum |

| Loan Security | Secured |

| Risk | Possibility of losing home if payments are not made |

| Customer Service | Varies by lender |

| Online Access | Varies by lender |

| Loan Prepayment | Possible with potential penalties depending on lender |

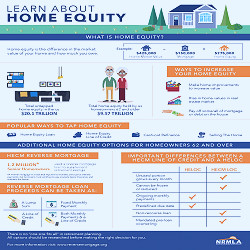

Understanding Home Equity

Home equity is the difference between the current market value of your home and the remaining balance on your mortgage. It's essentially the portion of your property that you truly 'own'. When you choose a home equity loan, you're borrowing against this equity. Read more

The Power of Fixed Interest Rates

One of the most attractive features of a home equity loan is its fixed interest rate. This means your monthly payments will remain the same throughout the duration of the loan, making budgeting easier and eliminating any future rate hike surprises. Read more

Using Home Equity Loans for Debt Consolidation

If you have high-interest debts, such as credit card balances, a home equity loan can be an effective tool for debt consolidation. By paying off these debts with a lower-interest home equity loan, you could save a significant amount in interest payments. Read more

The Benefit of Tax Deduction

In many cases, the interest paid on a home equity loan can be tax-deductible. This can be a major advantage if you're looking to reduce your annual tax liability, but it's important to consult with a tax advisor to understand the specifics. Read more

Potential Risks of Home Equity Loans

While home equity loans can be beneficial, there are risks involved. Your home is used as collateral, meaning if you fail to make your repayments, the lender could potentially foreclose on your home. It's crucial to assess your financial capacity before taking out such a loan. Read more

Loan Amount Determination

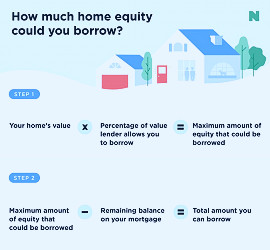

The amount you can borrow through a home equity loan is largely determined by the amount of equity you have in your home. Usually, lenders will allow you to borrow up to 85% of your home's value, minus what you still owe on the mortgage. Read more

Navigating the Application Process

Applying for a home equity loan involves a process similar to getting a primary mortgage. This includes a credit check, home appraisal, and a review of your income and debts. Be prepared to provide necessary documents to expedite the process. Read more

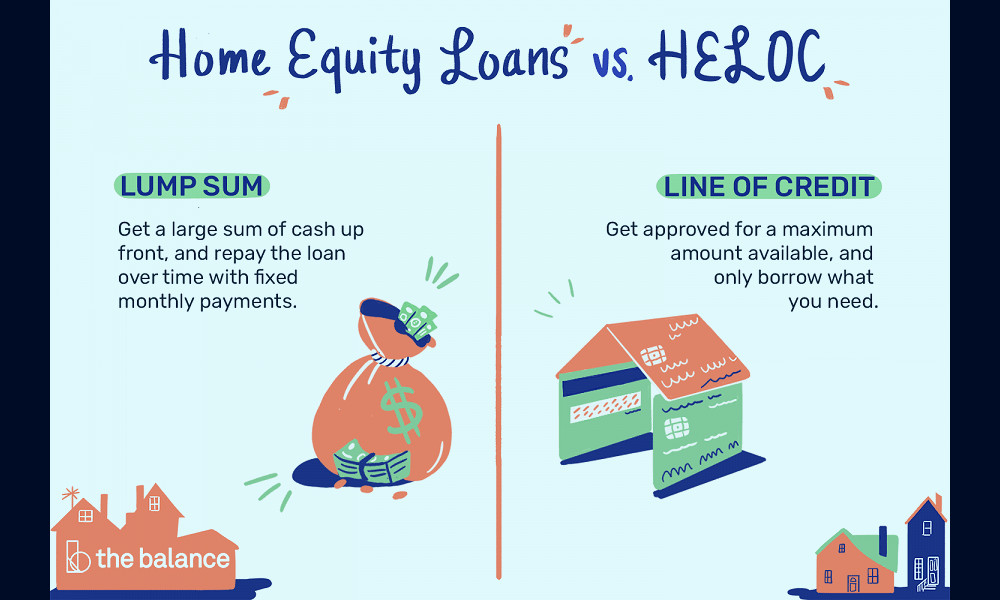

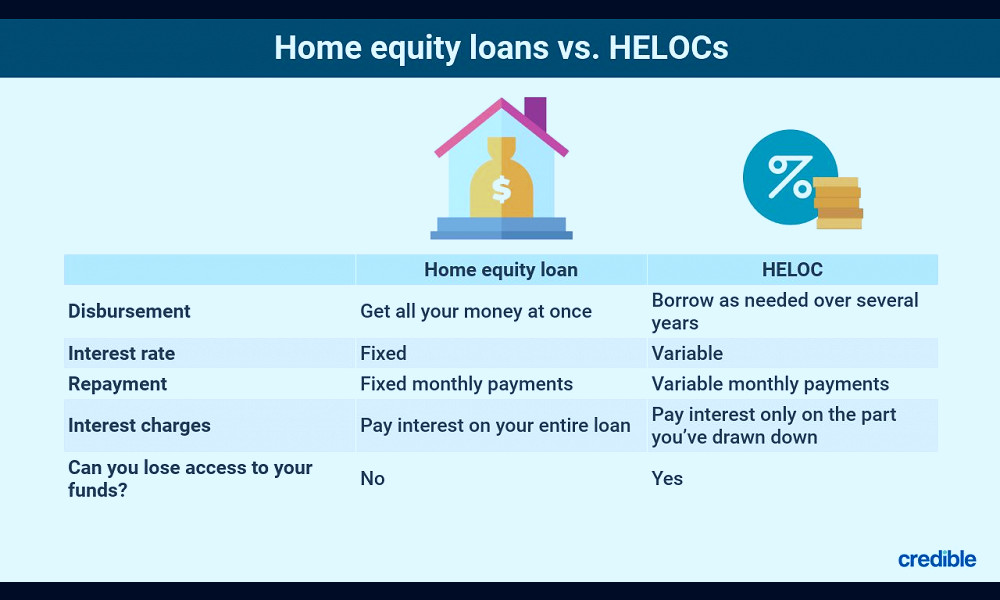

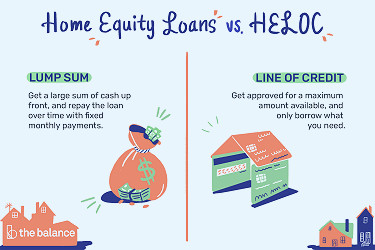

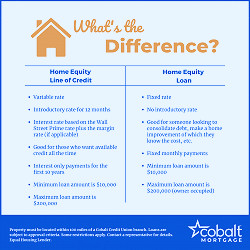

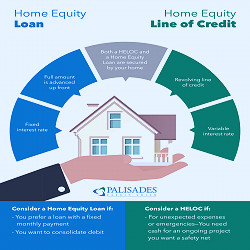

Home Equity Loans vs. Home Equity Lines of Credit

Unlike a home equity loan, a home equity line of credit (HELOC) works more like a credit card, providing you with a source of funds that you can draw on as needed. Understanding the difference between these two options can help you choose the right one for your needs. Read more

Consider Loan Terms

Home equity loans typically come with terms ranging from 5 to 15 years. Longer terms mean lower monthly payments but more interest over the life of the loan. Shorter terms will cost more per month but can save you money in the long run. Read more

Choosing the Right Lender

Not all lenders offer the same terms for home equity loans. It's important to compare loan terms and rates from several lenders before making a decision. Take time to read reviews and consider the lender's reputation and customer service. Read more

Facts

1. A Helping Hand for Homeowners: Did you know, home equity loans are like a helping hand for homeowners? A home equity loan allows you to borrow against the value of your home, providing you with the funds you need for big expenses like home improvements, debt consolidation, or even a dream vacation. It's a flexible financial tool that can be a real lifesaver!2. A Loan with Low-Interest Rates: Unlike many other types of loans, home equity loans often come with low-interest rates. This is because they're secured against your property, reducing the risk for the lender. So if you're in need of a large sum of money, a home equity loan could be a cost-effective option.

3. A Second Mortgage: Home equity loans are also known as second mortgages. This is because you're essentially taking out a second loan against your home. But don't let this scare you! As long as you manage your finances responsibly, this can be a smart and beneficial financial move.

4. The Power of Equity: The amount you can borrow with a home equity loan is dependent on the equity you've built up in your home. Essentially, the more of your mortgage you've paid off, the more you'll be able to borrow. This makes home equity loans a great option for long-standing homeowners.

5. The Risk of Foreclosure: However, it's important to note that with a home equity loan, your home is used as collateral. This means if you fail to make your loan repayments, you risk foreclosure. So, it's crucial to borrow responsibly and ensure you can comfortably afford the repayments.

6. Fixed Interest Rates: One of the best features of a home equity loan is that it typically comes with a fixed interest rate. This means your monthly payments are predictable and won't increase over time, making budgeting easier.

7. The Loan Term: Home equity loans usually have a loan term of 5 to 15 years. This gives you plenty of time to repay the loan, but keep in mind that the longer the term, the more interest you will pay over the life of the loan.

8. Tax Benefits: In some cases, the interest paid on a home equity loan is tax-deductible, which can lead to significant savings. Always consult with a tax professional to understand the potential tax implications.

9. Use of Funds: Unlike some loans, there are no restrictions on how you can use the funds from a home equity loan. Whether you want to remodel your kitchen, pay for your child’s education, or take a dream vacation, the choice is yours.

10. The Approval Process: The approval process for a home equity loan can take several weeks as the lender will need to appraise your home and evaluate your credit history. But the wait can be worth it for the access to funds at a lower interest rate.

Read more

How a Home Equity Loan Works, Rates, Requirements & Calculator

How a Home Equity Loan Works, Rates, Requirements & Calculator Home Equity Loan vs. Line of Credit | Clearview FCU

Home Equity Loan vs. Line of Credit | Clearview FCU What to Know About a Home Equity Loan | ESL Federal Credit Union

What to Know About a Home Equity Loan | ESL Federal Credit Union Getting a Home Equity Loan: What It Is and How It Works - NerdWallet

Getting a Home Equity Loan: What It Is and How It Works - NerdWallet What Is a Home Equity Loan?

What Is a Home Equity Loan? Home Equity Loan vs. Line of Credit | Cobalt Credit Union

Home Equity Loan vs. Line of Credit | Cobalt Credit Union Home Equity Loan vs. Mortgage: What's the Difference?

Home Equity Loan vs. Mortgage: What's the Difference? The Difference Between a Home Equity Loan and a Home Equity Line of Credit - Palisades Credit Union

The Difference Between a Home Equity Loan and a Home Equity Line of Credit - Palisades Credit Union Home Equity Loans – Forbes Advisor

Home Equity Loans – Forbes Advisor Low Rate Home Equity Loans - Beacon Credit Union

Low Rate Home Equity Loans - Beacon Credit Union Home Equity Loan - Frankenmuth Credit Union

Home Equity Loan - Frankenmuth Credit Union What is Home Equity? - Reverse Mortgage

What is Home Equity? - Reverse Mortgage Home Equity Loans: How They Work and How to Get One

Home Equity Loans: How They Work and How to Get One Your Choice Home Equity Loan | DoverFCU

Your Choice Home Equity Loan | DoverFCU Home equity loan or line of credit: Which is right for you? - Dupaco

Home equity loan or line of credit: Which is right for you? - Dupaco Home Equity Loans vs. Home Equity Lines of Credit | Mid-Hudson Valley Federal Credit Union

Home Equity Loans vs. Home Equity Lines of Credit | Mid-Hudson Valley Federal Credit Union Home Equity Loans vs. HELOC I Credello

Home Equity Loans vs. HELOC I Credello Home Equity Loan - Firstmark Credit Union

Home Equity Loan - Firstmark Credit Union SOCU - 🏠 Home Everything Loan

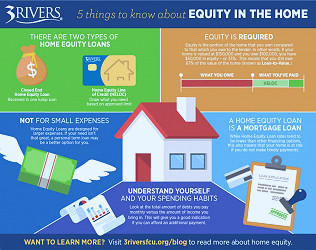

SOCU - 🏠 Home Everything Loan 5 Things to Know About Equity in the Home

5 Things to Know About Equity in the Home