Unleash Financial Freedom with No-Deposit Checking Accounts: Choose Better Banking Today!

A no-deposit checking account is a convenient banking solution that eliminates the need for an initial deposit to open the account. It offers easy access to your money for daily withdrawal needs and is perfect for those looking to manage their finances without the burden of maintaining a minimum balance. Equipped with online banking features, it allows you to pay bills, make transactions, and keep track of your finances with ease and efficiency. Start banking smarter today with a no-deposit checking account.

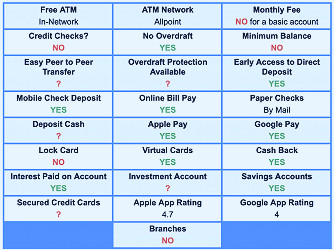

| Account type | Checking Account |

| Minimum Deposit | $0 |

| Monthly Maintenance Fee | Varies (could be $0 with certain conditions met) |

| Interest Rate | Varies (usually low or none) |

| ATM Access | Nationwide/International |

| Online Banking | Available |

| Mobile Banking | Available |

| Overdraft Protection | Available |

| Check Writing | Unlimited |

| Debit Card | Included |

| Direct Deposit | Available |

| FDIC Insured | Yes |

| Customer Service | 24/7 Phone Support/In-app messaging |

| Account Closing Fee | May apply |

| Physical Branches | May vary depending on bank |

| Wire Transfers | Available, fees may apply |

| Bill Pay | Available |

| Cash Deposit | May vary depending on bank |

| Account Alerts | Available |

| Deposit Hold Policies | Varies by bank |

| Bonus Offers | Varies by bank. |

Understanding No Deposit Checking Accounts

A no deposit checking account is a type of bank account that doesn't require an initial deposit to be made during the account opening process. This feature can make it more accessible for people who are just starting out or don't have a large sum of money to deposit. Read more

The Benefits of No Deposit Checking Accounts

One of the most significant benefits of a no deposit checking account is its accessibility. With no required initial deposit, more people can open a checking account and start managing their finances effectively. Read more

The Flexibility of No Deposit Checking Accounts

No deposit checking accounts typically offer the flexibility to deposit money into the account whenever you're able or ready. This can be an excellent feature for those who are living paycheck to paycheck or are just starting to manage their finances. Read more

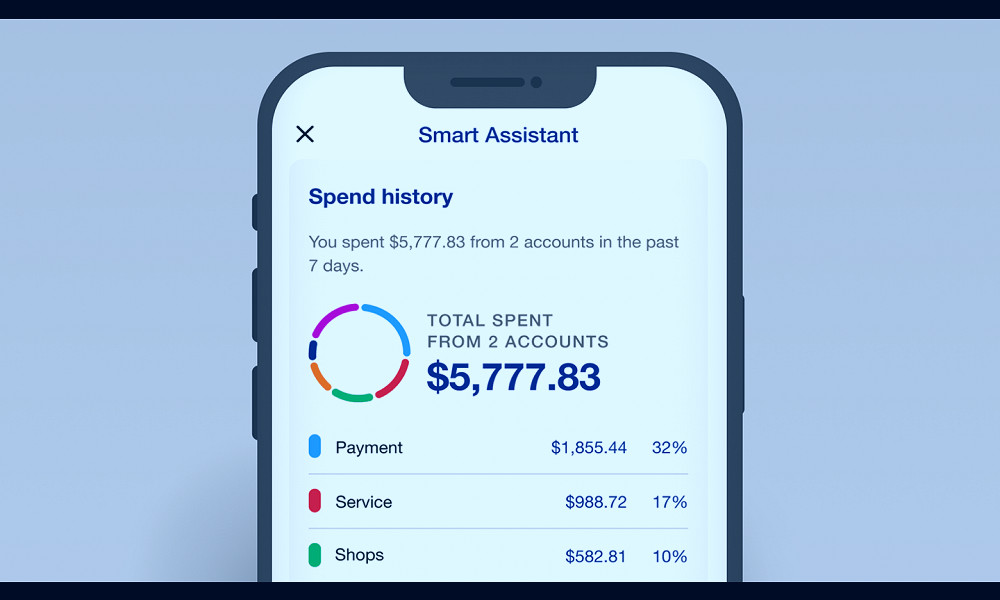

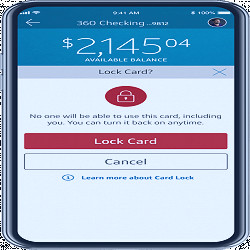

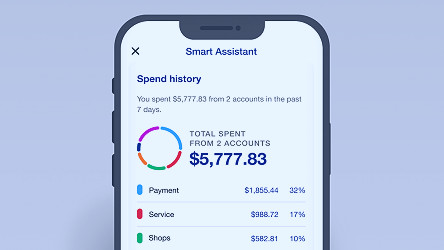

Online Access and Mobile Banking

Most no deposit checking accounts offer online banking and mobile banking features. These tools can make it easier to manage your money, track your spending, and pay your bills on time. Read more

Direct Deposit Feature

Many no deposit checking accounts also offer a direct deposit feature. This can be a convenient way to receive your paycheck or other regular income directly into your account, saving you time and reducing the risk of lost or stolen checks. Read more

Overdraft Protection

While not all no deposit checking accounts offer this feature, some do provide overdraft protection. This can help you avoid costly overdraft fees if you accidentally spend more than what's available in your account. Read more

Account Fees

It's important to note that while a no deposit checking account doesn't require an initial deposit, it may have other fees, such as monthly maintenance fees or ATM fees. Make sure you understand the fee structure before deciding on a no deposit checking account. Read more

Interest Rates

Some no deposit checking accounts may also offer an interest rate, allowing you to earn money on any balance you carry in your account. It's worth comparing interest rates when choosing a no deposit checking account. Read more

Customer Service

Good customer service is a crucial aspect to consider when choosing a no deposit checking account. You want a bank or credit union that will be responsive and helpful when you have questions or problems. Read more

Making the Decision

When choosing a no deposit checking account, it's essential to consider all the features and benefits and how they align with your financial needs and goals. While the absence of an initial deposit requirement can be attractive, make sure you also pay attention to other factors like fees, interest rates, and customer service. Read more

Facts

1. No Initial Deposit Required: What's more welcoming than a bank which allows you to open a checking account with no initial deposit? It's the perfect solution for those looking to establish a bank account without upfront cash.2. No Monthly Maintenance Fees: Some checking accounts with no deposit also offer the benefit of no monthly maintenance fees. So you're not just saving on the initial deposit, but also avoiding continuous charges.

3. Online Banking Features: Many banks offering checking accounts with no deposit also provide rich online banking features. These services may include online bill payments, mobile check deposit, and real-time balance updates.

4. ATM Access: Just because you're not required to make a deposit doesn't mean you're limited in your banking options. Many such accounts offer full ATM access, so you can manage your money on-the-go.

5. Credit Building Opportunities: Some banks offering no deposit checking accounts also offer credit building opportunities. This means that with regular account activity, you can start building, or rebuilding, your credit score.

6. Zero Balance Requirements: A zero balance requirement is another advantage of these accounts. No matter how low your balance gets, your account stays open, and you won't be charged a fee.

7. Overdraft Protection: Some no deposit checking accounts also come with overdraft protection. This means if you accidentally overspend, you won't be hit with a hefty fee.

8. Direct Deposit Capabilities: Even without an initial deposit, these accounts often offer direct deposit capabilities. Your paycheck can be deposited directly into your account, making your funds available immediately.

9. Mobile Banking Apps: Many banks with no deposit checking accounts also offer mobile banking apps. This allows you to manage your money anytime, anywhere, right from your smartphone or tablet.

10. Customer Support: Lastly, these banks typically offer excellent customer support. Whether you have a question or run into an issue, you can count on their team to provide you with the assistance you need.

Read more

How to Open an Online Bank Account with No Deposit - Cashry

How to Open an Online Bank Account with No Deposit - Cashry Online Checking Account | No-Fee 360 Checking | Capital One

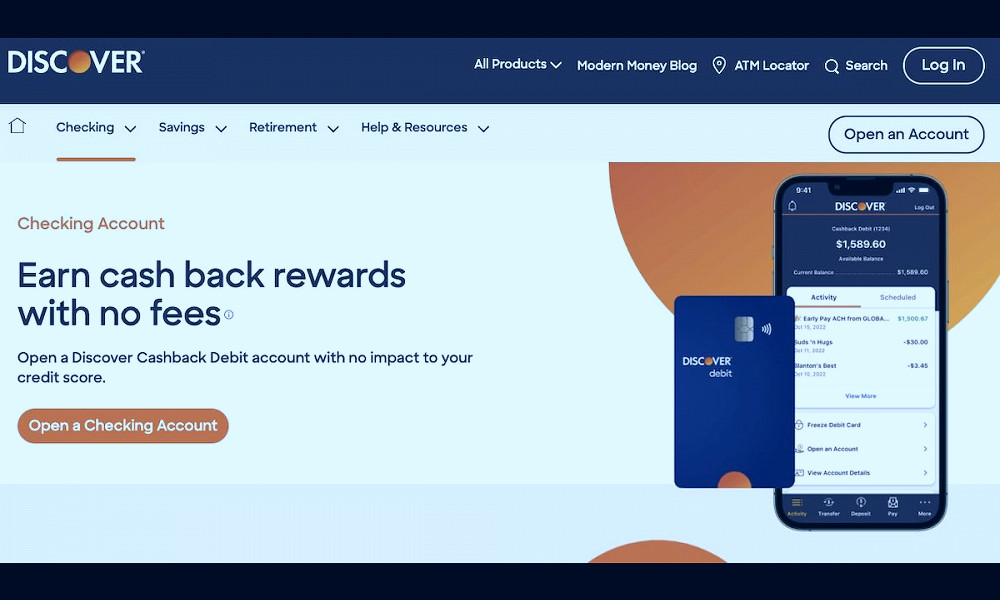

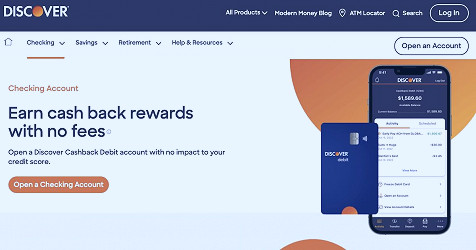

Online Checking Account | No-Fee 360 Checking | Capital One Checking Account - No Fees with Cashback Debit | Discover

Checking Account - No Fees with Cashback Debit | Discover 18 Bank Accounts You Can Open Even if You Have Bad Credit

18 Bank Accounts You Can Open Even if You Have Bad Credit Can I Open A Bank Account With No Deposit? | Monorail

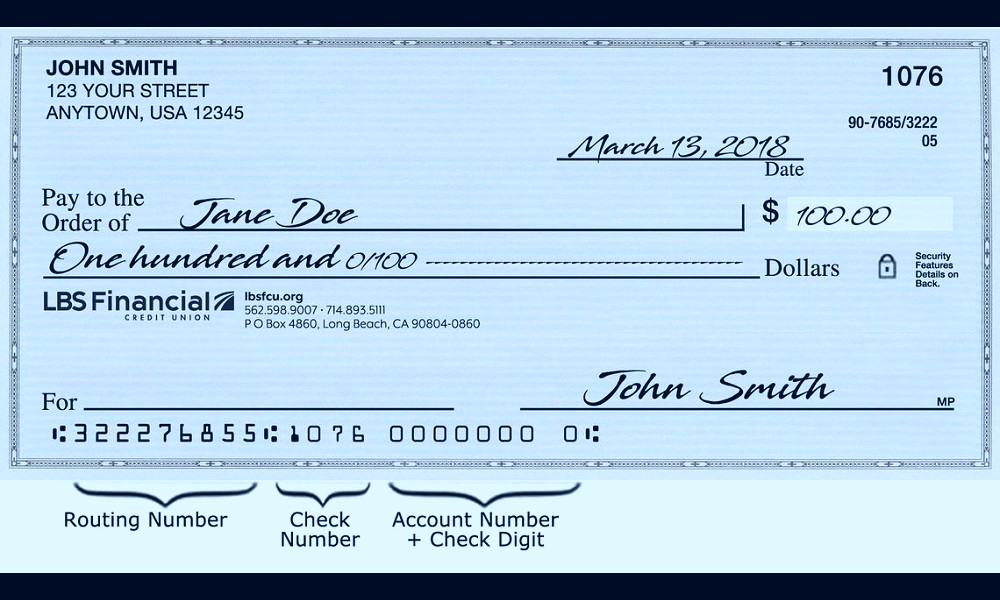

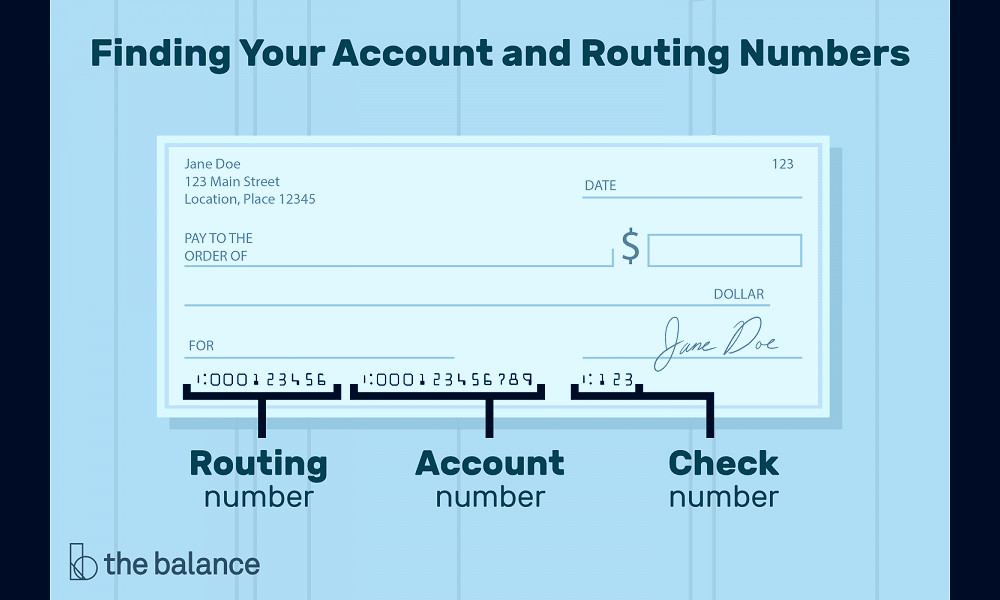

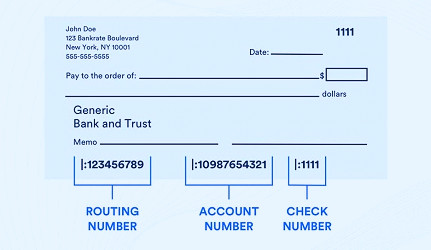

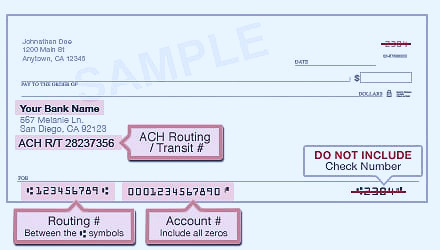

Can I Open A Bank Account With No Deposit? | Monorail Where Is The Account Number On A Check? | Bankrate

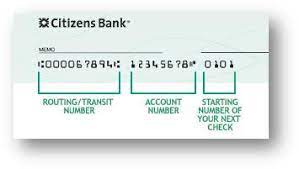

Where Is The Account Number On A Check? | Bankrate Open a Personal Checking Account Online | Citizens

Open a Personal Checking Account Online | Citizens Can I Open a Bank Account With No Deposit? - Chime

Can I Open a Bank Account With No Deposit? - Chime Open a Bank Account Online with No Deposit and Bad Credit: BankBonus

Open a Bank Account Online with No Deposit and Bad Credit: BankBonus Online checking account | Open a checking account | U.S. Bank

Online checking account | Open a checking account | U.S. Bank Online Checking Account with No Monthly Fees | Chime

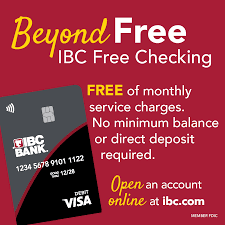

Online Checking Account with No Monthly Fees | Chime IBC Bank - Open a Free Checking account online at ibc.com. No minimum balance or direct deposit required. Free Instant Issue Visa debit card at account opening. #BeyondFree #FreeChecking #FreeIsGood #WeDoMore Member

IBC Bank - Open a Free Checking account online at ibc.com. No minimum balance or direct deposit required. Free Instant Issue Visa debit card at account opening. #BeyondFree #FreeChecking #FreeIsGood #WeDoMore Member Open a Personal Checking Account Online | Citizens

Open a Personal Checking Account Online | Citizens Checking Account - No Fees with Cashback Debit | Discover

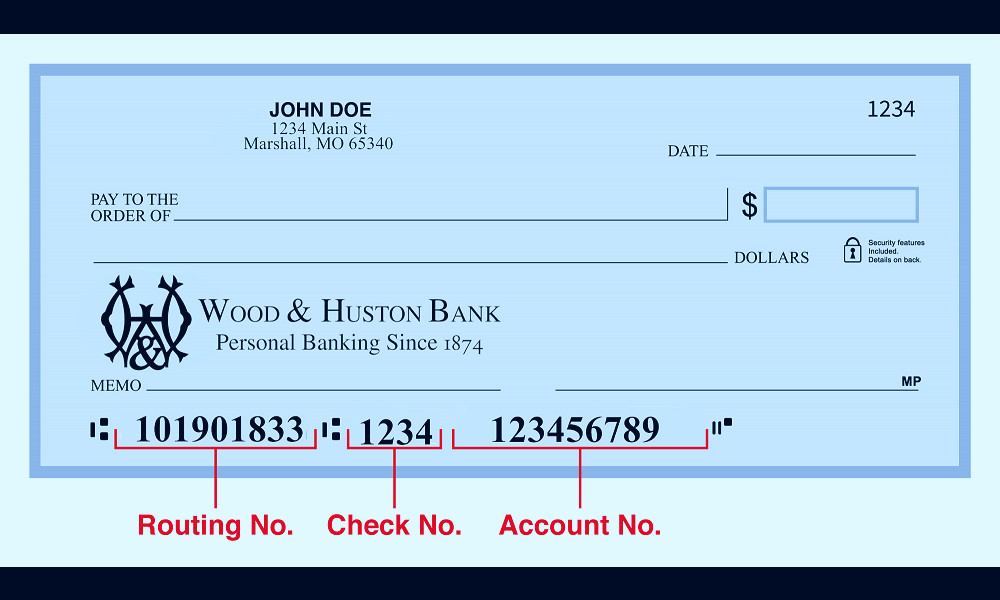

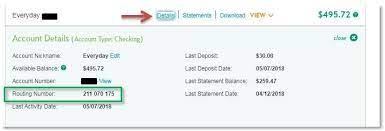

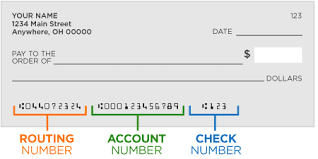

Checking Account - No Fees with Cashback Debit | Discover Which number on my check is the routing number?

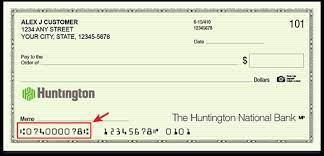

Which number on my check is the routing number? How to Read a Check | Huntington Bank

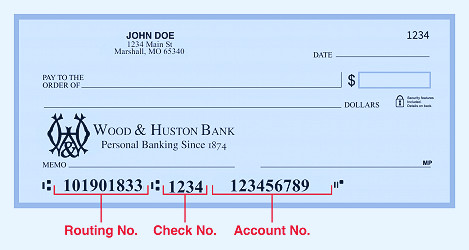

How to Read a Check | Huntington Bank Wood & Huston Bank - Other Services - Wood & Huston Bank Routing Number 101901833

Wood & Huston Bank - Other Services - Wood & Huston Bank Routing Number 101901833 Locate Routing and Account Numbers on a Check – Nationwide

Locate Routing and Account Numbers on a Check – Nationwide Checking Account - No Fees with Cashback Debit | Discover

Checking Account - No Fees with Cashback Debit | Discover Valley Credit Union - Open a Checking Account in Salem, OR

Valley Credit Union - Open a Checking Account in Salem, OR