Empower Your Finances: Choose the Best Budgeting Software Today!

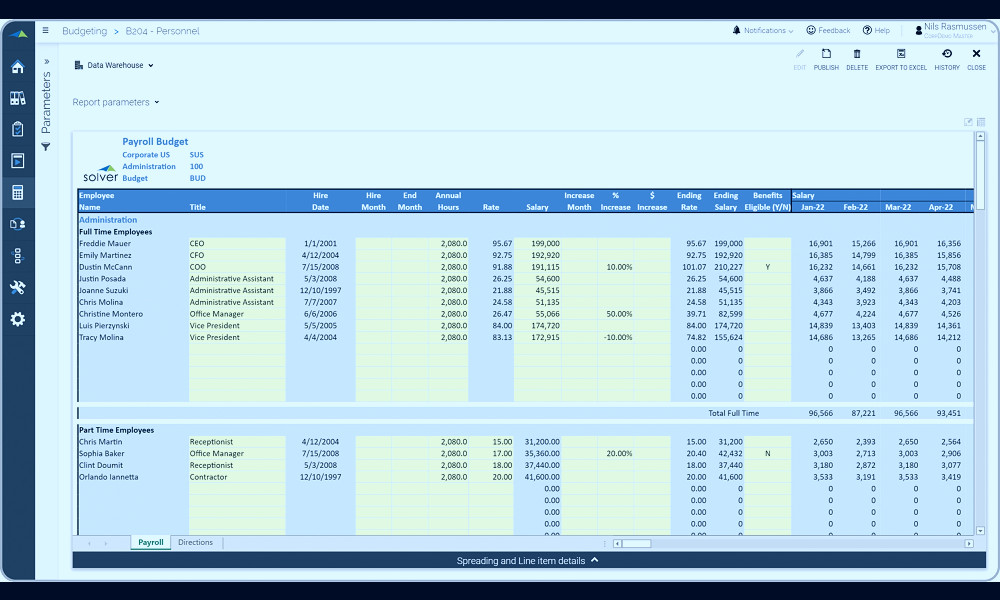

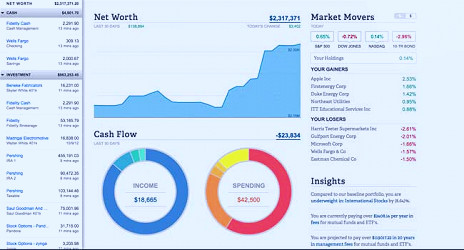

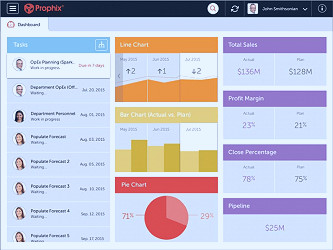

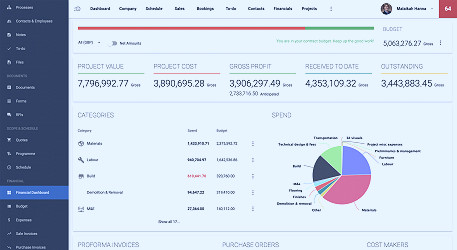

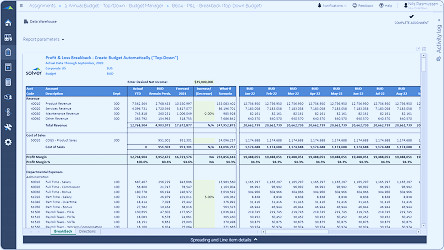

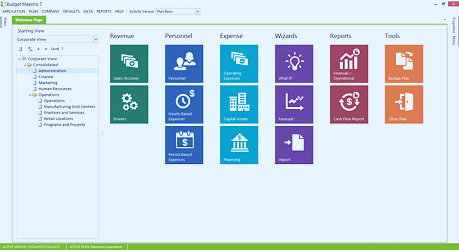

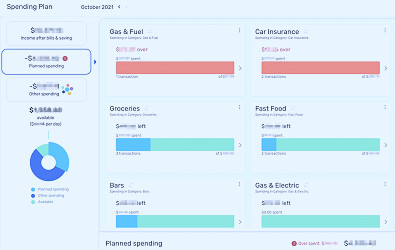

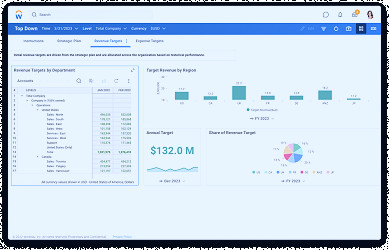

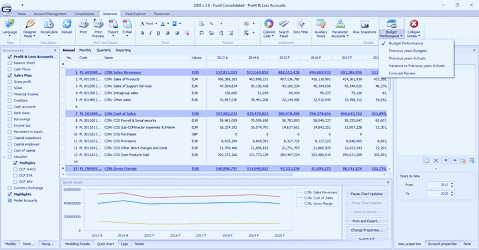

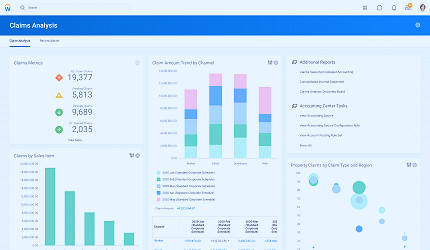

Budgeting software is a digital tool designed to help you manage your finances effectively. It allows you to track income, expenses, savings, and investments, providing detailed insights into your spending habits. With features for setting financial goals, creating custom budgets, and generating reports, budgeting software makes it easy to take control of your financial health. Whether you're planning a family budget, running a small business, or managing a large corporation, budgeting software is an essential tool for successful financial planning.

| Brand | Unknown |

| Type | Budgeting Software |

| License | Commercial, Free, Open Source |

| Platform | Windows, Mac, Linux, Web-based |

| Features | Expense Tracking, Income Tracking, Budgeting, Financial Reporting, Forecasting, Goal Setting |

| User Level | Personal, Small Business, Large Business |

| Integration | Bank integration, Credit Card integration, Accounting Software Integration |

| Security | SSL Encryption, Two-Factor Authentication |

| Support | Email Support, Live Chat, Phone Support, Online Tutorials |

| Pricing | Monthly Subscription, Annual Subscription, Lifetime Purchase |

| Free Trial | Available / Not Available |

| User Reviews | Positive, Negative |

| Languages Supported | English, Spanish, French, German, etc. |

| Mobile Application | iOS, Android |

| Release Date | Unknown |

| Latest Version | Unknown |

| Developer | Unknown |

Understanding Your Financial Needs

Before deciding on a budgeting software, you need to understand your financial needs. Do you need a program that simply tracks your income and expenses, or do you want something more advanced that can help with investment tracking, tax planning, and retirement planning? Knowing your needs will help you to choose a software that suits you best. Read more

Ease of Use

Budgeting software should be user-friendly. A complex interface can discourage you from using the software regularly. Look for software that offers a clean, intuitive interface and a user-friendly design. Read more

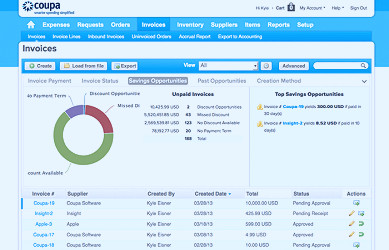

Integration Capabilities

The best budgeting software can integrate with your financial institutions. This feature allows automatic updates of your financial data, making the budgeting process effortless. Read more

Security Measures

Your budgeting software will have access to sensitive financial data. Therefore, it is crucial to ensure that the software you choose uses advanced security measures, such as encryption and two-factor authentication, to protect your information. Read more

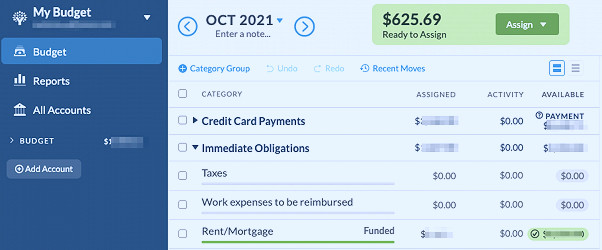

Customization Features

Every person's financial situation is unique, and your budgeting software should reflect that. Look for software that allows you to customize categories, create your own budgeting rules, and adjust the settings to fit your personal financial goals. Read more

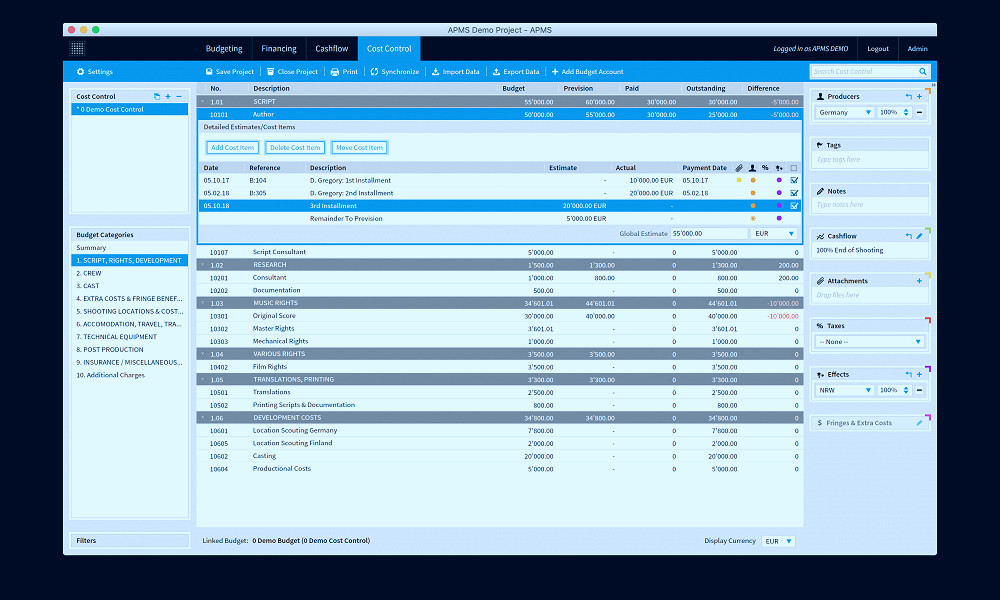

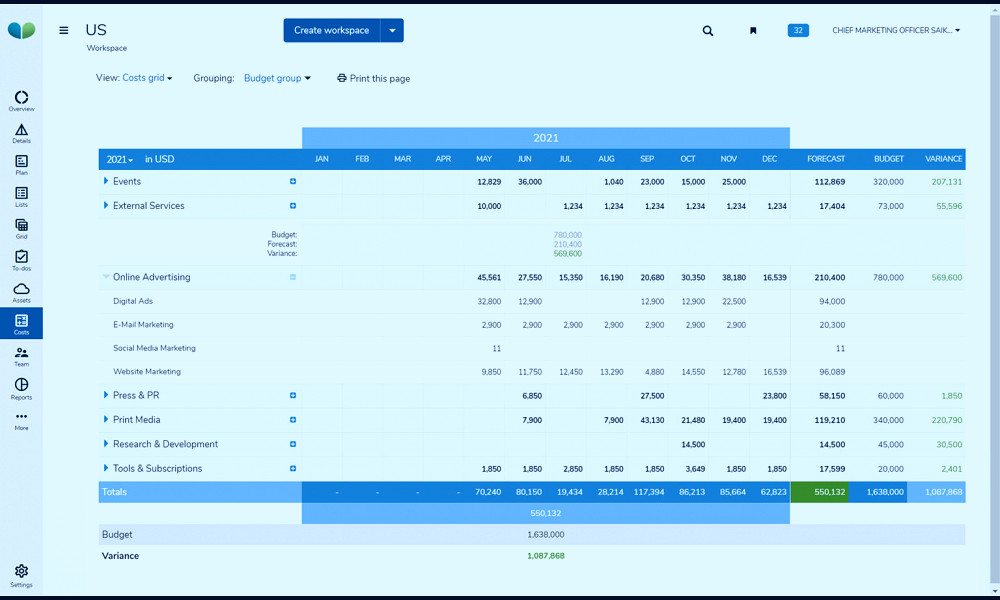

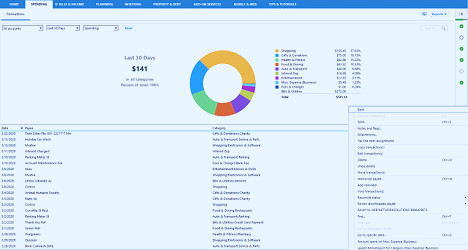

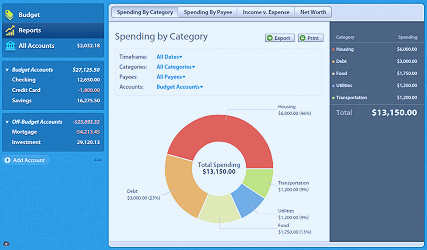

Reporting and Analysis Tools

Comprehensive reporting and analysis tools can give you a deep insight into your spending habits. They can show you where your money is going, help you identify areas where you can save, and track your progress towards your financial goals. Read more

Cost vs. Value

Some budgeting software is free, while others require a subscription fee. It's essential to weigh the cost against the value you're getting. A free software may lack the features and functionality you need, while a paid one might offer more advanced features that can help you manage your finances more effectively. Read more

Customer Support

Good customer support can make a significant difference in your experience with budgeting software. Look for a company that offers prompt and helpful support, whether it's through email, live chat, or phone. Read more

Reviews and Ratings

Before making a decision, check out the reviews and ratings of the budgeting software. They can give you a sense of what real users think about the product, its features, and its performance. Read more

Trial Periods

Many budgeting software providers offer trial periods. This is a great opportunity to test out the software and see if it's the right fit for you before making a commitment. Make sure to take full advantage of this feature to ensure you're choosing the best budgeting software for your needs. Read more

Facts

1. Skyrocketing Savings: Did you know using budgeting software can increase your savings by 20%? It's like finding money you never knew you had. It's an eye-opener to your spending habits and helps you identify areas where you can cut back.2. Superior Security: Your financial information is your most prized possession. The best budgeting software uses bank-level security measures to ensure that your data is safe. It's like having a personal vault for your financial information.

3. Fast & Efficient Tracking: Forget about those cumbersome spreadsheets! With budgeting software, you can track your income and expenditure in real-time. It's like having a financial assistant working for you 24/7.

4. Goal Getter: Want to buy a house? Plan a vacation? With budgeting software, you can set and track your financial goals. It helps you visualize your progress and motivates you to stay on track. It's like having a personal coach cheering you on towards financial success.

5. Bye Bye Late Fees: Never miss a bill payment again! Budgeting software can send you reminders and alerts for upcoming payments. It's like having a personal secretary managing your financial calendar.

6. Future Forecasting: Want to know what your financial future looks like? Some budgeting software can analyze your spending habits and predict your future finances. It’s like having a crystal ball for your money.

7. Debt Destroyer: Struggling with debt? Budgeting software can help you create a debt repayment plan. It's like having a personal advisor guiding you out of the debt maze.

8. Couples Coordination: Manage and synchronize your finances with your partner. By using budgeting software, you can avoid financial misunderstandings and work towards shared goals. It's like a relationship counselor for your finances.

9. Investment Insight: Some budgeting software can even track your investments and provide you with valuable insights. It's like having a personal stockbroker at your fingertips.

10. Learning & Growth: Want to become financially savvy? Budgeting software often provides educational resources and insights to help you understand and improve your financial health. It's like attending a personal finance masterclass in the comfort of your home.

Read more

14 Best Business Budgeting Software & Tools | Scoro

14 Best Business Budgeting Software & Tools | Scoro Try Top 5 Budget Software

Try Top 5 Budget Software 14 Best Business Budgeting Software & Tools | Scoro

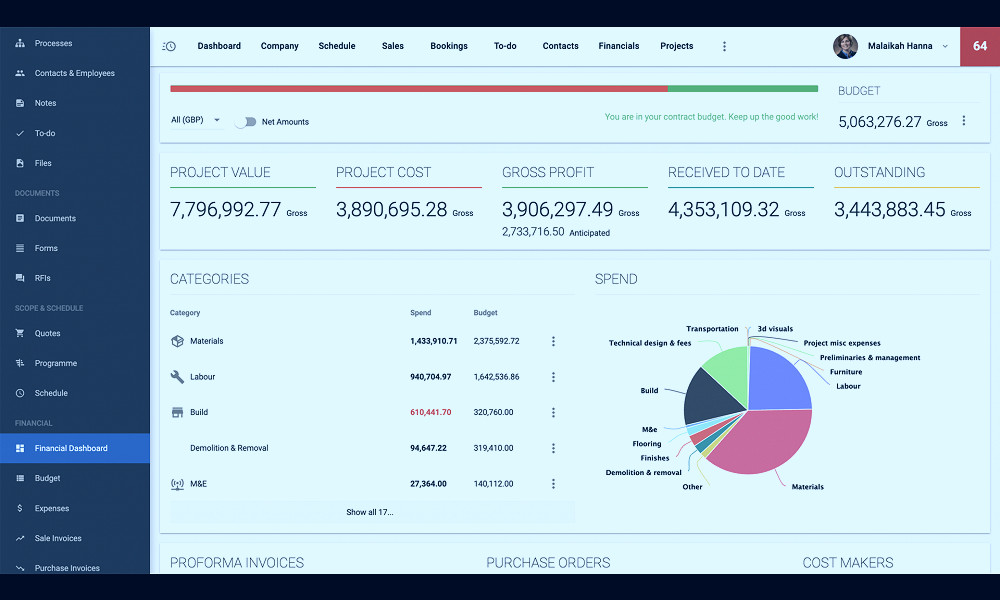

14 Best Business Budgeting Software & Tools | Scoro See the 7 Best Construction Budget Software Tools in 2023

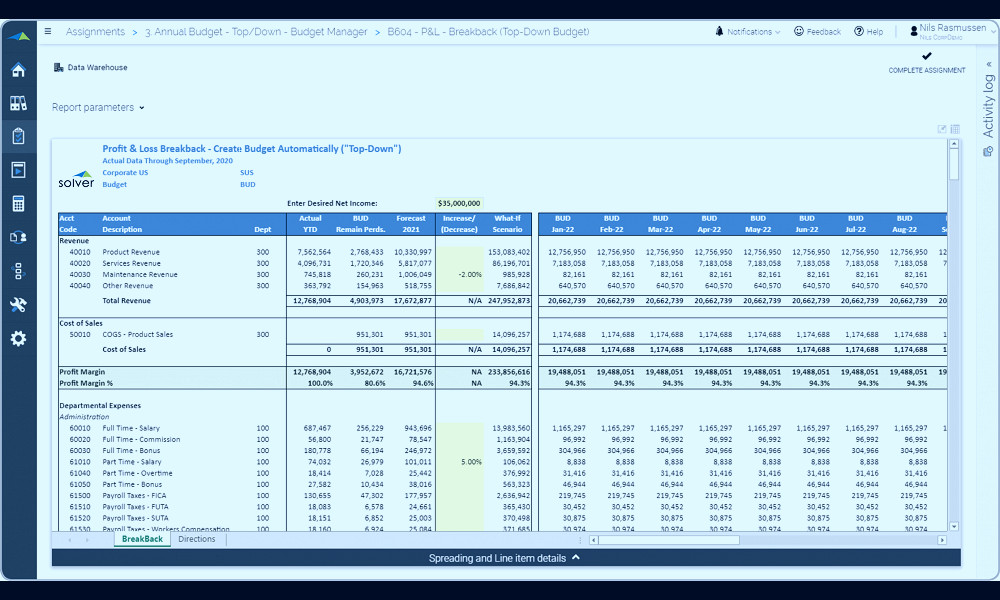

See the 7 Best Construction Budget Software Tools in 2023 Corporate Budgeting & Forecasting Software | Solver CPM Solution

Corporate Budgeting & Forecasting Software | Solver CPM Solution Construction Budgeting Software - Try free for 14 days - Planyard

Construction Budgeting Software - Try free for 14 days - Planyard Corporate Budgeting Software | BPM Partners

Corporate Budgeting Software | BPM Partners 14 Best Business Budgeting Software & Tools | Scoro

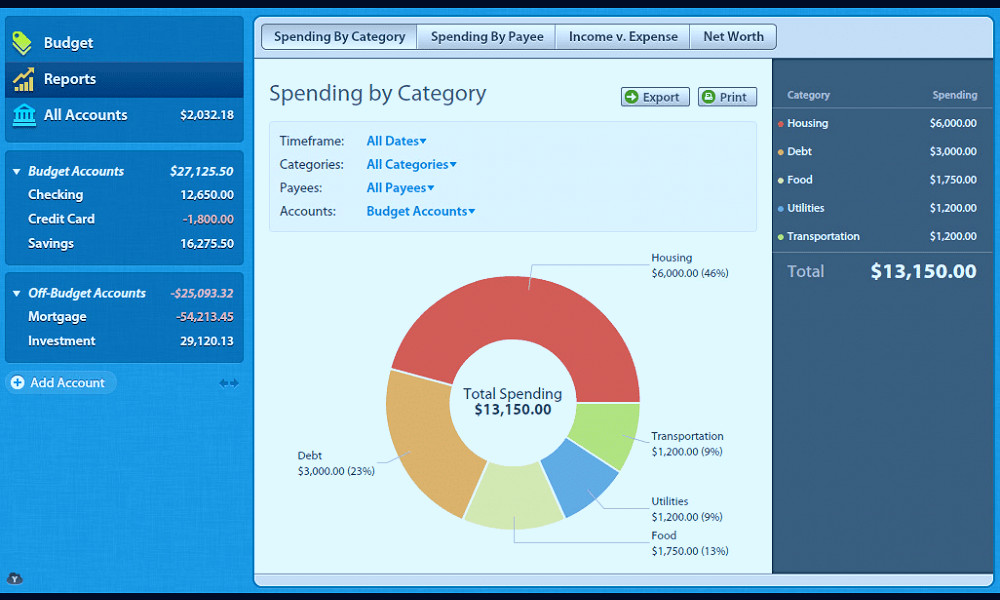

14 Best Business Budgeting Software & Tools | Scoro The Best Personal Finance Software for 2023 | PCMag

The Best Personal Finance Software for 2023 | PCMag The 2 Best Budgeting Apps for 2023 | Reviews by Wirecutter

The 2 Best Budgeting Apps for 2023 | Reviews by Wirecutter 14 Best Business Budgeting Software & Tools | Scoro

14 Best Business Budgeting Software & Tools | Scoro You Need a Budget" Software For Personal Finance

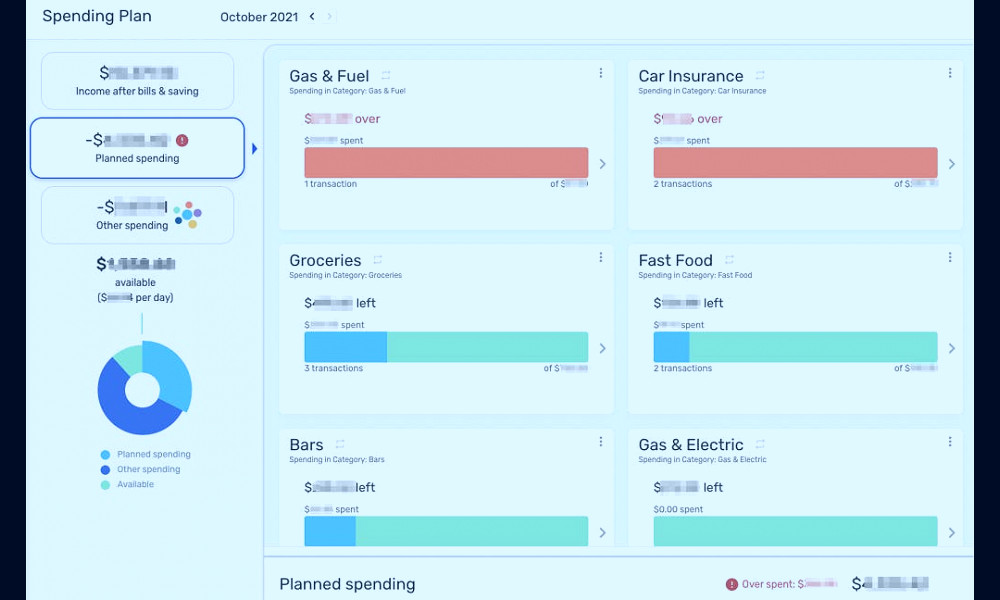

You Need a Budget" Software For Personal Finance The 2 Best Budgeting Apps for 2023 | Reviews by Wirecutter

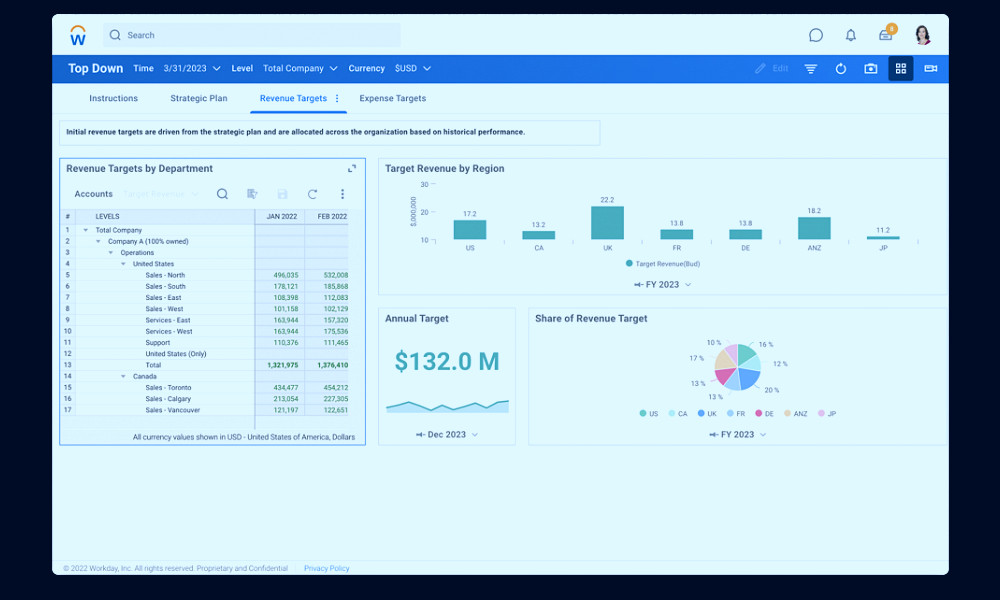

The 2 Best Budgeting Apps for 2023 | Reviews by Wirecutter Agile Planning, Budgeting, and Forecasting Software | Workday

Agile Planning, Budgeting, and Forecasting Software | Workday Budgeting Software - List of Top Budgeting Applications

Budgeting Software - List of Top Budgeting Applications 7 business budgeting tools for smart finance teams

7 business budgeting tools for smart finance teams 14 Best Business Budgeting Software & Tools | Scoro

14 Best Business Budgeting Software & Tools | Scoro 14 Best Budgeting Software for Personal & Business Finance in 2023 💸

14 Best Budgeting Software for Personal & Business Finance in 2023 💸 20 Best Budgeting Software Solutions of 2023 - Financesonline.com

20 Best Budgeting Software Solutions of 2023 - Financesonline.com Best Budgeting Software 2023 - Reviews on 209+ Tools | GetApp

Best Budgeting Software 2023 - Reviews on 209+ Tools | GetApp